Compare to a payday loan or a cash advance

Experience a fast and hassle-free loan process with PD Quick Cash. Enjoy the benefits of no credit checks, no waiting periods, and no application fees. Get same-day approval and have the funds promptly deposited directly into your People Driven Credit Union account. PD Quick Cash Loans are exclusively available to PDCU members who have had a direct deposit set up for at least three months. Loan amounts range from $500 to $2,000.

When life happens, we are here for you.

Whether you need extra cash for college, groceries, an emergency car repair, or anything in between, PDCU is here to help. In under 60 seconds, you can get money when you need it most deposited directly into your account; no credit check is required!

PD Quick Cash can help you build or repair your credit and is a smart alternative to high-interest loans.

It’s easy to apply for PD Quick Cash! Do it anytime, anywhere, via online or mobile banking.

The Deal

- Loan amounts range from $500-$2,000

- Repayment terms of 12-24 months based on the amount accepted

- Loan Origination Fee: $12-$35 depending on the loan amount.

- 19.99% Interest Rate

- Maximum Annual Percentage Rate (APR): 24.71% (Actual APR may vary from 21.83% – 24.71% estimated range based on loan amount and term).

TruStage™ Payment Guard Insurance

With a PD Quick Cash Loan from People Driven Credit Union, you don’t just get fast access to funds—you also get free loan insurance! Our PD Quick Cash Loans now come with TruStage™ Payment Guard Loan Insurance, automatically included at no additional cost to you.

In the event of a covered job loss, TruStage™ Payment Guard Insurance provides a lump sum payment of $500 toward your loan balance, helping to ease your financial burden during challenging times. Stay protected and secure your financial future with a PD Quick Cash Loan and TruStage™ Payment Guard Insurance.

How to apply for PD Quick Cash

In this video, we cover:

- How to easily apply for PD Quick Cash.

- The process of instant loan approval and fund deposition.

- A step-by-step guide on reviewing loan offers and receiving your disclosures via email.

The Advantages

Affordable: Enjoy zero loan application fees and a low loan origination fee due after you are approved and withdrawn from the loan proceeds.

Swift Access: Get quick access to cash when you need it the most.

No Credit Report Required: Apply without the worry of credit checks.

Flexible Borrowing: Borrow between $500 and $2,000 to cover those unforeseen costs.

Easy Repayment: With up to 24 months for repayment, manage your finances at your own pace.

Insured: $500 of relief in the event of a job loss.

The Requirements

- Member Benefits: Exclusive to our Credit Union members of at least three months with good standing (limited to two loans per member).

- Convenient: Must have direct deposit, making the process smooth and straightforward.

The Example:

For a PD Quick Cash loan of $500 paid off over 12 months:

| Amount Financed: | $500.00 |

| Interest Rate: | 19.99% |

| Origination Fee: | $12.00 |

| Payment Guard Insurance: | Free |

| APR: | 24.71% |

| Payment Every Month: | $47.31 |

| Total # of Payments: | 12 |

| Total Interest: | $67.73 |

| Total of Payments: | $567.73 |

The Application

People Driven Credit Union members in good standing, with direct deposit set up for at least three months, are invited to apply online for the PD Quick Cash Loan.

Applications submitted online will receive a decision on the loan approval or denial in minutes.

The funds will be deposited directly into the member’s account within 60 seconds if approved.

The credit report of the PD Quick Cash loan applicant will not be checked. Apply online today.

Frequently Asked Questions

- For the Quick Cash Loan, visit the Quick Cash Loan Application

- For the Summertime Cash Loan, visit Personal Loan Options You can also call us at (248) 263-4100 for assistance.

- Quick Cash Loan: No credit check is required.

- Summertime Cash Loan: Yes, standard credit review applies and may affect your interest rate and approval amount.

- Quick Cash Loan: Funds may be deposited into your account within minutes after approval.

- Summertime Cash Loan: Typically funded within 5 business days upon final approval and document signing.

- PD Summertime Quick Cash Loan: Up to $2,000, 9.99% APR, no credit check, $15 fee, available only to current members with qualifying direct deposit.

- PDCU Summertime Cash Loan: Up to $30,000, available to both members and non-members, with credit and membership approval.

Follow these steps to enable email notifications:

- Open the Mail app on your iPhone.

- To receive notifications about replies to emails or threads:

- When reading an email: Tap the left arrow and tap Notify Me.

- When writing an email: Tap the Subject field, tap the blue bell in the subject field, and then tap Notify Me.

- To adjust how notifications appear:

- Go to Settings > Apps > Mail > Notifications, then turn on Allow Notifications.

- To customize notification settings for your email account:

- Go to Settings > Apps > Mail.

- Tap Notifications and ensure Allow Notifications is turned on.

- Tap Customize Notifications and choose the settings you want for your email account (e.g., Alerts or Badges).

- You can also adjust alert tones or ringtones if you turn on Alerts.

Some members using Apple devices have reported being kicked out of the app when retrieving the security code sent to their email during the Holiday Loan application process. This happens when members leave the app to check their email for the code, which causes the app to restart. This issue doesn’t seem to affect Android devices.

To avoid being kicked out of the application process, read How can I avoid being kicked out of the app when I receive the security code?

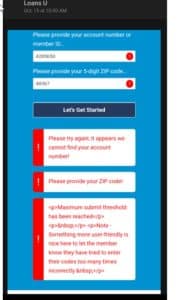

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.The origination fee for a PD Quick Cash loan is a one-time cost for convenience and speed. It allows you to secure funds instantly without a traditional credit check. This is particularly beneficial when you need urgent access to funds without the usual wait times or paperwork involved in standard loan processing. It's designed to be a fast, straightforward solution for immediate financial needs.

The origination fee varies depending on the loan amount requested:

- Loan Amount $500-$999: Origination Fee $12

- Loan Amount $1000-$1500: Origination Fee $25

- Loan Amount $1501-$2000: Origination Fee $35

You Might Also Be Interested In…

The Disclosures

Loans from $500-$2,000. 19.99% Interest Rate. Actual APR may vary (21.83% – 24.71% estimated range based on loan amount and term).

- Loan Amount $500-$999: Origination Fee $12

- Loan Amount $1000-$1500: Origination Fee $25

- Loan Amount $1501-$2000: Origination Fee $35

People Driven Credit Union (PDCU) will not accept requests to change the payment transfer method or due date for funded PD Quick Cash loans. By applying for and funding a PD Quick Cash loan, members agree to an automatic loan transfer scheduled 30 days from the loan date.

PDCU Member PD Quick Cash Qualifications

PD Quick Cash Loans are only available for Members of People Driven Credit Union. Members are permitted to have up to two PD Quick Cash Loans simultaneously; however, a 30-day waiting period is required between loan applications. People Driven Credit Union members in good standing, with a direct deposit set up for at least three months, are invited to apply online for the PD Quick Cash Loan. Online applications will receive an approval or denial decision within minutes. If approved, funds will be deposited directly into the member’s account within 60 seconds. Credit reports will not be checked for PD Quick Cash loan applicants.

Membership in People Driven Credit Union is open to:

Michigan Residents. Persons who reside, work, attend school or worship anywhere in the state of Michigan.

Employees or pensioners of agencies of the federal government of the United States of America who live or work in the State of Michigan, or who report to a federal agency headquarters located in the state of Michigan.

Employees or pensioners or agencies of any state, county, or local government, or any political subdivision thereof located within Wayne, Oakland or Macomb Counties, Michigan.

Employees or retired employees of the following: Ford Motor Company or Visteon Corporation, who work in Rawsonville or Wixom, MI; members of the Red Carpet Club, a retirees’ association in Washtenaw, Oakland, Macomb, Monroe or Wayne Counties, MI; Tower Automotive who work in Plymouth, MI; and Ford Utica Trim Plant.

Employees or retired employees of the following: Ford Motor Company, Visteon Corporation, Automotive Components Holdings, L.L.C. or Faurecia, who worked in Ypsilanti, Rawsonville, Saline, Milan, Highland Park, Mount Clements, Wixom, or in Shelby or Chesterfield Townships, MI or at the Ford Proving Grounds in Macomb County, Michigan; Ford New Holland; Ford Romeo Engine Plant who worked in Romeo, MI Oakman Industrial Engine Plant in Detroit, MI Johnson Controls Inc.; Hoover Automotive Systems Group who work in Utica, MI; AutoAlliance International, Inc. Mazda (North America), Inc; Mazda Research & Development of North America, Inc.; Mazda System Services and Mount Clemens Coating, Inc. who worked in Mount Clemens; and Tower Automotive who worked in Plymouth, MI.

Employees of this credit union.

Results of the merger of Sinai Health Services Credit Union, Detroit, MI, effective July 1, 1992

Results of the merger of M.E.S. Credit Union, Detroit, Michigan, effective January 1, 2004

Results of the merger of Peoples Trust Credit Union and Community Driven Credit Union, effective July 1, 2014

Results of the merger of Community Alliance Credit Union effective January 1, 2023

Members and immediate families of the foregoing.

Any legal entity that is comprised for the most part of the same general group as the membership of the credit union as outlined above.

A spouse of a deceased member if accepted into membership prior to remarriage.

Family Membership. Anyone related to a PDCU member by blood or marriage, regardless of where they live or work in the U.S.

Retirees. Anyone over age 55 (or younger, if on disability retirement) who receives a retirement annuity, pension, social security, or other retirement payment from private or government sources and lives in, or belongs to, a retirement organization located in Wayne, Oakland, Macomb, St. Clair, Lapeer, Genesee, Livingston or Washtenaw counties.

Truth in Lending Disclosure:

Security: You are giving a security interest in your shares and deposits in the credit union, as well as the collateral described below. Collateral for other loans with us will also secure this loan, except for your home and household goods.

Late Charges: If your account is 25 days or more late, you will be charged 20% of the interest due or a minimum of $10.00.

Required Deposit Balance: The Annual Percentage Rate does not take into account your required deposit balance.

Property Insurance: You may obtain property insurance from anyone you want that is acceptable to the credit union. If you do not obtain property insurance we will obtain it at your cost.

Prepayment: If you pay off early, you will not have to pay a penalty.

See your contract documents for any additional information about nonpayment, default, any required repayment in full before the scheduled date, and prepayment refunds and penalties.

“e” means estimate.

LOAN SIGNATURES

You agree that the terms and conditions in the disclosure statement and the loan and security agreements attached hereto shall apply to this loan. If there is more than one borrower, you agree that all the conditions of the loan and security agreements governing this loan shall apply to both jointly and severally. You acknowledge that you have received a copy of the loan and security agreements and disclosure statement (“Note”). If you purchase optional loan products in connection with this loan, you understand that a portion of the premium or fee you pay will be retained by the credit union (or paid back to the credit union by the service provider) as compensation for making these services available to you. You also acknowledge receipt of the product application(s), disclosures, and contract(s) regarding the product(s).

Suspension of electronic services and access to share or deposit accounts. Subject to applicable law, we may suspend some or all electronic services and access to your checking or other account(s) if you become delinquent on any of your loan or deposit obligations to us or you cause a loss to us. We shall not be liable to you in any regard in connection with such suspension of services.

Negative Information Notice: We may report information about your account to credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected in your credit report.

NOTICE TO CONSUMER: THIS IS A CONSUMER CREDIT TRANSACTION. (A) DO NOT SIGN ANYTHING BEFORE YOU READ IT OR IF IT CONTAINS ANY BLANK SPACES. (B) YOU ARE ENTITLED TO AN EXACT COPY OF ANY AGREEMENT YOU SIGN. (C) YOU HAVE THE RIGHT AT ANY TIME TO PAY IN ADVANCE THE UNPAID BALANCE DUE UNDER THIS AGREEMENT.

THIS WRITTEN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES.

CAUTION- IT IS IMPORTANT THAT YOU THOROUGHLY READ THE CONTRACT BEFORE YOU SIGN IT.

*OTHER OWNER: Any person who has a property interest (other than as a renter or lessor) in the above described collateral signs here. The other owner, unless also a co-borrower, is not obligated to pay the debt, but understands that the credit union has a security interest in the collateral as explained in the Security Agreement.

**GUARANTOR: Upon default, the credit union may seek immediate payment from the guarantor of any and all sums due on the loan, including all reasonable costs and fees provided under the loan and security agreements, as permitted by law. The guarantor waives all notice to which he or she would otherwise be entitled by law.

NOTICE: ANY HOLDER OF THIS CONSUMER CREDIT CONTRACT IS SUBJECT TO ALL CLAIMS AND DEFENSES WHICH THE DEBTOR COULD ASSERT AGAINST THE SELLER OF GOODS OR SERVICES OBTAINED PURSUANT HERETO OR WITH THE PROCEEDS HEREOF. RECOVERY HEREUNDER BY THE DEBTOR SHALL NOT EXCEED AMOUNTS PAID BY THE DEBTOR HEREUNDER.

IMPORTANT DISCLOSURES FOR ACTIVE MEMBERS OF THE MILITARY AND THEIR DEPENDENTS:

The following applies if at the time this loan is made you are an active member of the military or a dependent (as those terms are defined in the Military Lending Act (MLA), 10 U.S.C. 987 and its implementing regulations (“MLA”)), and (a) your loan is unsecured or secured by personal property or a vehicle that you did not purchase with the proceeds of the loan; or (b) it is otherwise determined by law that the MLA applies to your loan. If this loan is a revolving line of credit or credit card, the MLA ceases to apply at any time during which you are not a member of the military or a dependent (as defined in the MLA).

NOTICE: Federal law provides important protections to members of the Armed Forces and their dependents relating to extensions of consumer credit. In general, the cost of consumer credit to a member of the Armed Forces and his or her dependent may not exceed an annual percentage rate of 36 percent. This rate must include, as applicable to the credit transaction or account: the costs associated with credit insurance premiums or debt protection fees; fees for ancillary products sold in connection with the credit transaction; any application fee charged (other than certain application fees for specified credit transactions or accounts); and any participation fee charged (other than certain participation fees for a credit card account). To receive this notice verbally, please call 1-844-700-7328 during our normal business hours.

This loan will not be secured by a consensual lien on shares or deposits in any of your accounts unless you agree to establish an account in connection with this loan (“Secured Account”). Only funds deposited into the Secured Account after the loan is made will secure this loan. Any cross-collateralization provision contained in your loan or account documents will not apply to the Secured Account or your other share or deposit accounts for any loan subject to the Military Lending Act.

However, we reserve our statutory lien rights and rights to set-off or administrative freeze under federal or state law, which gives us the right to apply the sums in the Secured Account or any other account(s) you have with us to satisfy your obligations under this loan.

Any reference in this consumer credit contract to the following are hereby inapplicable to your loan: (a) Mandatory arbitration; (b) Any requirement(s) to waive your rights to legal recourse under any applicable state or federal law; (c) Any demands or requirements construed as unreasonable notice from you in order to exercise your legal rights; or (d) Prepayment penalties.

Any provisions in your consumer credit contract, loan, security, or account agreements that are determined to be inconsistent with or contradictory to these disclosures or the MLA (as they may be changed or amended from time to time) are inapplicable with regard to this loan. However, all other terms and conditions of the consumer credit contract shall remain in full force and effect.

IN THESE AGREEMENTS, THE WORDS “YOU,” “YOUR” AND “YOURS” MEAN ALL THOSE NAMED AS BORROWERS. THE WORDS “WE,” “US” AND “OUR” MEAN THE CREDIT UNION.

LOAN AGREEMENT

Payments/Finance Charges: For value received, you promise to pay, at our office, all amounts due. All payments shall be made pursuant to the disclosure statement on page 1 of this document. You understand that the finance charge and total of payments shown on page 1 of this document are based on the assumption that all installment payments will be made on the scheduled due dates. If you fail to pay any installment by the time it is due, you will pay additional interest on the overdue amount and your loan may not be paid in full at the end of the term. In such case, any remaining balance will be due in full immediately.

Allocation of Payments and Additional Payments: Payments and credits shall be applied in the following order: any amounts past due; any fees or charges owing, including any fees or premiums for additional products purchased; accrued interest or finance charges; outstanding principal. Payments made in addition to regularly scheduled payments shall be applied in the same order.

Late Charges: If you make a late payment, you agree to pay a late charge if one is disclosed on page 1 of this document.

Borrower Responsibility: You promise to notify us of any change in your name, address or employment. You promise not to apply for a loan if you know there is a reasonable probability that you will be unable to repay your obligation according to the terms of the credit extension. You promise to inform us of any new information which relates to your ability to repay your obligation. You promise not to submit false or inaccurate information or willfully conceal information regarding your creditworthiness, credit standing, or credit capacity.

Default: The following provision applies to borrowers in Idaho, Kansas, and Maine: You will be in default if (1) you do not make a payment of the required amount when due; or (2) we believe the prospect of payment, performance, or realization on any property given as security is significantly impaired.

The following provision applies to borrowers in Wisconsin: You shall be in default under this Agreement if any of the following occur: (a) If an amount exceeding one (1) full payment due under this Agreement is more than ten (10) days late or if the first or last payment due under this Agreement is more than forty (40) days late; OR (b) you breach any term or condition of this Agreement, which breach materially impairs your ability to pay amounts when due or materially impairs the condition, value, or protection of our rights to or in any collateral securing this transaction.

The following provision applies to all other borrowers: You shall be considered in default if any of the following occur: (1) If you break any promise made under this Loan Agreement or under the Security Agreement; or (2) if you do not use the money we loaned you for the purpose stated in your application; or (3) if we should, in good faith, believe that prospect of payment, performance or realization of the collateral, if any, is impaired; or (4) if you die; or (5) if you file a petition in bankruptcy, insolvency, or receivership or are put involuntarily into such proceedings; or (6) if the collateral, if any, given as security for this loan is lost, damaged or destroyed, or if it is levied against, attached, garnished, or seized for any reason under any authority; or (7) if you do not pay on time any of your current or future debts to us; or (8) if anyone is in default of any security agreement given in connection with any loan under this Note; or (9) If you make any false or misleading statements in any credit application or update of credit information; or (10) you are in default of any other loan or security agreement you have with the Credit Union; or (11) you use the Note for any illegal purpose or transaction as determined by applicable law. If you default, we may, at our option, declare this loan immediately due and payable, and you must immediately pay to us at that time the total unpaid balance, as well as the Finance Charge to date, any late charges and costs of collection permitted under law, including reasonable attorney’s fees.

Costs of Collection: You shall pay all costs incurred by us in collecting any amount you owe or in enforcing or protecting our rights. Costs of collection include, but are not limited to, collection agency fees, repossession fees, appraisals, environmental site assessments, and casualty insurance. The following applies to all borrowers except Wisconsin borrowers: Costs of collection also include reasonable attorney’s fees for any action taken by an attorney who is not our salaried employee in order to collect this loan or preserve or protect our rights and remedies, including, without limitation, presuit demands for payment, pre-suit mediation or settlement negotiations, investigation and assessment of our rights, participation in bankruptcy cases, matters, and proceedings (including, without limitation, filing proofs of claim, pursuing reaffirmation agreements, attending meetings of creditors, and pursuing complaints, motions, and objections that relate in any way to the credit union’s collateral or right to payment), collateral disposition, nonbankruptcy suits and/or administrative actions, and appeals. For Alabama borrowers: attorney’s fees after default shall not exceed 15% of the unpaid debt, or such higher amount as a court may allow. For Georgia borrowers: attorney’s fees shall not exceed 15% of principal and accrued interest, or such higher amount as a court may allow.

Action Upon Default: The following provision applies to borrowers in Colorado, District of Columbia, Kansas, Maine, Massachusetts, Missouri, Nebraska, and West Virginia: Once you have defaulted, and after the expiration of any right you may have under applicable state law to cure your default, we can demand immediate payment of the entire unpaid balance of the loan without giving you advance notice. The principal balance in default shall bear interest at the contract rate, or a default rate if one has been disclosed to you, or another rate if required by applicable law.

The following provision applies to borrowers in Wisconsin:

Right to Cure Default: If you are in default under this Agreement, we must give a notice of default to you pursuant to Wisconsin Statutes sec. 425.104 and 425.105. You shall have fifteen (15) calendar days from the date the notice is mailed to you to cure the default. In the event of an uncured default, we shall have all the rights and remedies for default provided under the Wisconsin Consumer Act, Uniform Commercial Code, or other applicable law, including, but not limited to, the right to repossess the collateral. We may waive any default without waiving any other subsequent or prior default by you.

No Right to Cure: Pursuant to Wis. Stat. Sec. 425.105(3), you shall not have the right to cure a default if the following occur twice during the preceding twelve (12) months: (a) you were in default on the closed-end note; (b) we gave you notice of the right to cure such previous default in accordance with Wis.Stat.Sec. 425.104; and (c) you cured the previous default.

Nothing in this Agreement shall be construed to restrict our ability to exercise our rights under the Wisconsin Consumer Act, Uniform Commercial Code, or other applicable law, including, but not limited to, the right to repossess the collateral.

The following provision applies to borrowers in all other states: Once you have defaulted, we may, at our option, declare all amounts under the Note immediately due and payable, and you must immediately pay to us at that time the total unpaid balance, as well as the Finance Charge to date, any late charges and costs of collection permitted under law, including reasonable attorney’s fees. The principal balance in default shall bear interest at the contract rate.

Delay In Enforcement: We may delay enforcing any of our rights under this agreement without losing them.

Irregular Payments: We may accept late payments or partial payments, even though marked “payment in full,” without losing any of our rights under this agreement.

Co-borrowers: If you are signing this agreement as a co-borrower, you agree to be equally responsible with the borrower, but we may sue either or both of you. We do not have to notify you that this agreement has not been paid. We may extend the terms of payment and release any security without notifying or releasing you from responsibility on this agreement.

Governing Law: These agreements shall be construed and enforced in accordance with the laws of the State in which our headquarters are located.

If you have entered into a mandatory arbitration agreement in connection with this loan: if any provisions within this Agreement pertaining to jurisdiction and venue are inconsistent with the arbitration agreement, the arbitration agreement will govern.

Change in Terms: The terms of this Closed-end Note, Disclosure, Loan & Security Agreement, including any fees disclosed, are subject to change without prior notice, subject to applicable law.

Contractual Pledge of Shares: You pledge all your shares and deposits in the credit union, including future additions, as security for this loan. In case you default, we may apply these shares and deposits to the payment of all sums due at the time of default, including costs of collection and reasonable attorney’s fees. No lien or right to impress a lien on shares and deposits shall apply to any of your shares which may be held in an “Individual Retirement Account” or “Keogh Plan.”

State Notices:

NOTICES TO WISCONSIN BORROWERS: No provision of a marital property agreement, a unilateral agreement under Wis. Stat. Section 766.59, or a court decree under Wis. Stat. 766.70 adversely affects the interest of the Credit Union unless prior to the time the credit is extended, the Credit Union is furnished with a copy of the agreement or statement, or has actual knowledge of the adverse provision when the obligation to the Credit Union is incurred.

NORTH DAKOTA NOTICE TO BORROWERS PURCHASING A MOTOR VEHICLE – THE MOTOR VEHICLE IN THIS TRANSACTION MAY BE SUBJECT TO REPOSSESSION. IF IT IS REPOSSESSED AND SOLD TO SOMEONE ELSE, AND ALL AMOUNTS DUE TO THE SECURED PARTY ARE NOT RECEIVED IN THAT SALE, THE BORROWER MAY HAVE TO PAY THE DIFFERENCE.

NOTICE TO UTAH BORROWERS: This written agreement is a final expression of the agreement between you and the Credit Union. This written agreement may not be contradicted by evidence of any oral agreement.

NOTICE FOR ARIZONA OWNERS OF PROPERTY: It is unlawful for a borrower to fail to return a motor vehicle that is subject to a security interest within thirty days after you have received notice of default. The notice will be mailed to the address you provided on this document unless you have given the Credit Union a new address. It is your responsibility to notify the Credit Union if your address changes. The maximum penalty for unlawful failure to return a motor vehicle is one year in prison and/or a fine of $150,000.

NOTICE TO CALIFORNIA RESIDENTS: By signing this Note, you specifically agree that the Credit Union may access the records of the California Department of Motor Vehicles from time to time to obtain your current mailing address, and by so agreeing, you are specifically waiving your rights under sections 1808.21 and 1808.22 of the California Vehicle Code.

NOTICE TO TEXAS BORROWERS – INSURANCE REQUIRED: You are required to: (i) keep the collateral insured against damage in the amount of the loan or another amount if we so specify; (ii) purchase this insurance from an insurer that is authorized to do business in the state of Texas or an eligible surplus lines insurer; and (iii) name us as the person to be paid under the policy in the event of a loss. You must also provide us a copy of the policy and proof of the payment of premiums if we so request. If you fail to meet any of these requirements, we may obtain collateral protection insurance on your behalf at your expense.

For Missouri Residents: Oral agreements or commitments to loan money, extend credit or to forbear from enforcing repayment of a debt including promises to extend or renew such debt are not enforceable. To protect you (borrower) and us (creditor) from misunderstanding or disappointment, any agreements we reach covering such matters are contained in this writing, which is the complete and exclusive statement of the agreement between us, except as we may later agree in writing to modify it.

For Vermont Residents: NOTICE TO CO-BORROWER: YOUR SIGNATURE ON THIS LOAN MEANS THAT YOU ARE EQUALLY LIABLE FOR REPAYMENT OF THE LOAN. IF THE BORROWER DOES NOT PAY, THE LENDER HAS A LEGAL RIGHT TO COLLECT FROM YOU.

OHIO RESIDENTS ONLY: The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers, and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

WASHINGTON AND OREGON RESIDENTS ONLY:

WARNING: UNLESS YOU PROVIDE US WITH EVIDENCE OF THE INSURANCE COVERAGE AS REQUIRED BY OUR LOAN AGREEMENT, WE MAY PURCHASE INSURANCE AT YOUR EXPENSE TO PROTECT OUR INTEREST. THIS INSURANCE MAY, BUT NEED NOT, ALSO PROTECT YOUR INTEREST. IF THE COLLATERAL BECOMES DAMAGED, THE COVERAGE WE PURCHASE MAY NOT PAY ANY CLAIM YOU MAKE OR ANY CLAIM MADE AGAINST YOU. YOU MAY LATER CANCEL THIS COVERAGE BY PROVIDING EVIDENCE THAT YOU HAVE OBTAINED PROPER COVERAGE ELSEWHERE. YOU ARE RESPONSIBLE FOR THE COST OF ANY INSURANCE PURCHASED BY US. THE COST OF THIS INSURANCE MAY BE ADDED TO YOUR LOAN BALANCE. IF THE COST IS ADDED TO THE LOAN BALANCE, THE INTEREST RATE ON THE UNDERLYING LOAN WILL APPLY TO THIS ADDED AMOUNT. THE EFFECTIVE DATE OF COVERAGE MAY BE THE DATE YOUR PRIOR COVERAGE LAPSED OR THE DATE YOU FAILED TO PROVIDE PROOF OF COVERAGE. THE COVERAGE WE PURCHASE MAY BE CONSIDERABLY MORE EXPENSIVE THAN INSURANCE YOU CAN OBTAIN ON YOUR OWN AND MAY NOT SATISFY WASHINGTON’S OR OREGON’S MANDATORY LIABILITY INSURANCE LAWS.

SECURITY AGREEMENT

Security Interest; PLEDGE OF SHARES; Statutory Lien; Set-off; Administrative Freeze: To secure the payment of this loan and all expenditures incurred by the credit union in connection with this loan: (a) You grant the Credit Union a security interest in the property described on Page 1 of this document (“Collateral”). The security interest includes all increases, substitutions and additions to the secured property, proceeds from any insurance on the secured property and all earnings received from the secured property. The security interest also includes all accessions. Accessions are things which are attached to or installed in the property now or in the future. The security interest also includes any replacements for the property which you buy within 10 days of the loan or any extensions, renewals or refinancing of the loan. If the value of the property declines, you promise to give us more security if asked to do so. You also agree to abide by the terms of the Security Agreement. (b) YOU GRANT AND PLEDGE TO US A CONSENSUAL LIEN ON ALL SUMS ON DEPOSIT to secure your obligations to the credit union pursuant to applicable state law. “All sums on deposit” and “shares” for purposes of this pledge means all deposits in any share savings, share draft, club, certificate, P.O.D., revocable trust or custodial accounts(s), whether jointly or individually held, that we have on deposit now or in the future, all of which are deemed “general deposits” for the purpose of this pledge. Your pledge does not include any IRA, Keogh, tax escrow, irrevocable trust or fiduciary account in which you do not have vested ownership interest. (c) You acknowledge and agree to impressment of the Credit Union’s statutory lien rights under the Federal Credit Union Act and/or applicable state law as of the date of your loan, which gives us the right to apply the sums in your account(s), to satisfy any obligations you owe to the credit union, regardless of contributions at the time of default, and without further notice to you or any owner of the account(s). (d) You acknowledge and agree to our “common law” right to set off under applicable state law which authorizes us to apply the funds in any joint or individual account to any obligations owed to us if you default or fail to pay or satisfy any obligation to us without any legal process, court proceeding or any notice to any owner of the account(s) affected hereunder or otherwise under this Agreement. (e) You specifically agree that we have a right to place an administrative freeze on any of your joint or individual account(s) and that such action shall not violate 11 USC 362 or other applicable law. IF YOU HAVE A CREDIT CARD WITH US, OUR RIGHTS ALSO APPLY TO THAT CREDIT CARD ACCOUNT.

Multiple Rights; Cumulative Remedies: You understand and agree that the Credit Union has multiple rights as enumerated above and that the remedies are cumulative. Nothing herein shall limit or restrict the remedies available to us following any event of default under the terms of your loan documents.

Cross-collateralization: Property given as security for this loan or for any other loan Borrower has with the credit union will secure all amounts Borrower owes the credit union now and in the future. However, property securing another debt will not secure this loan if such property is Borrower’s principal residence (unless the proper rescission notices are given and any other legal requirements are satisfied), or are non-purchase money household goods. IF YOU HAVE A CREDIT CARD WITH US, THIS CROSS-COLLATERALIZATION CLAUSE ALSO APPLIES TO THAT CREDIT CARD.

Release of Lien: We will not release any lien on any collateral under this Note if you are delinquent on, or in default on, any other loan you have with us. For example, if you are in default on a line of credit, we will not release our lien on a vehicle loan, even if the vehicle loan is current or paid in full.

Transfer of Collateral: You will not change the location of, sell or transfer the collateral unless you have our prior written consent.

Good Title: You warrant that you have good title to the collateral, free of all security interests except that given to the credit union and except for any interest of a non-co-maker owner of the collateral who has signed the agreement in the indicated place.

Maintenance of Collateral: You will pay all taxes, assessments, and liens against or attached to the property described and further agree to keep the property in good condition, housed in a suitable shelter. You agree to execute financing statements and security agreement amendments at our request and will defend the property against adverse third party claims.

Additional Security: Should we feel at any time that the security presented has diminished in value, or for any reason feel that additional security is required, you agree to assign to us within ten (10) days whatever additional security we feel is necessary to protect us against possible loss.

Actions Upon Default: If a default as defined in the Loan Agreement should occur, we, or a third party designated by us, have the authority, upon such default, to repossess and sell the collateral in a lawful manner. This includes authority to take possession of any personal property contained in the collateral. In such cases, we or our authorized representatives may, at our option, enter the premises where the collateral is kept and take possession, subject to applicable laws. We have the right to render the property pledged as collateral unusable and may dispose of the collateral on the premises where the collateral is kept. If we decide to sell the collateral at a public sale, private sale or otherwise dispose of the collateral, we will provide reasonable notice if required by law and will otherwise comply with applicable state law. If we sell or otherwise dispose of the collateral we may collect from you reasonable expenses incurred in the retaking, holding and preparing the collateral for and arranging the sale of the collateral. We may also collect reasonable attorney’s fees and legal expenses, permitted by applicable law, incurred in connection with disposition of the property. Unless you default, you may keep possession of the property (collateral) described and use it in any lawful manner consistent with this agreement or with the insurance policy on the collateral. You understand that we have certain rights and legal remedies available to us under the Uniform Commercial Code and other applicable laws, and that we may use these rights to enforce payment if you default. In the event of default, you will at our request assemble the property (collateral) and make it available to us at a place of our choosing. If we decide to waive this default, it will not constitute waiver of any other subsequent defaults.

Attorney-in-Fact: We are hereby appointed as your Attorney-in-Fact to perform any acts which we feel are necessary to protect the collateral and the security interest which this agreement creates.

Joint Borrowers: If there is more than one borrower, your obligations under this agreement are joint and several, each being equally responsible to fulfill the terms of this agreement.

Others Bound: This security agreement not only binds you, but your executors, administrators, heirs, and assigns.

Further Assurances: You agree to execute any further documents, and to take any further actions, reasonably requested by Credit Union in order to evidence or perfect the security interests granted herein or to effectuate the rights granted to Credit Union.

Governing Law: This Security Agreement is being executed and delivered in, and is intended to be performed in, the State in which our headquarters are located and shall be construed and enforced in accordance with the laws of the State in which our headquarters are located, except to the extent that the Uniform Commercial Code provides for the application of the law of another state.

Additional Advances: Any additional advances made by us for the payment of taxes or assessments or liens of any kind, or premiums on insurance and the interest owing thereon or any other advance necessary to perfect or protect our security interest shall also be secured by this agreement. Such amounts shall be added to your loan balance and your minimum payment due shall be increased or your loan term extended accordingly.

Applies to Louisiana residents only:

Louisiana law permits repossession of motor vehicles upon default without further notice or judicial process.

If the secured collateral is a motor vehicle and you are in default, we may seize and sell the motor vehicle without demand for payment or advance notice to you. Collateral other than motor vehicles may be repossessed without judicial process only as allowed by applicable Louisiana law.

For purposes of foreclosure under Louisiana executory process, you hereby confess judgment in our favor for all amounts secured by the Note, including, but not limited to, principal, interest, late charges, costs of collection, costs of preservation of the collateral, reasonable attorney’s fees, and all other amounts under the Note. We may appoint a keeper of the property in the event of foreclosure. To the extent allowed under Louisiana law, you hereby waive the following rights and procedures under Louisiana law: (a) all rights and benefit of appraisal; (b) notice of seizure; (c) the 3-day delay afforded under Articles 2331 and 2722; and (d) all other provisions under Articles 2331, 2722 and 2723 and all other Articles not specifically mentioned herein. You further agree that any declaration of fact made by authentic act by a person declaring that such facts are within his or her knowledge shall constitute authentic evidence of facts for the purposes of foreclosure under applicable Louisiana law and for the purposes of LSA-R.S. 9:3504(D)(6) and LSA-R.S. 10:9-508, to the extent applicable.

PROPERTY INSURANCE; LENDER-PLACED INSURANCE – PLEASE READ CAREFULLY

(a) Your requirement to maintain property insurance. You are required to carry insurance to protect your interest and our interest in the collateral securing this loan. The insurance:

• Must protect against any loss by fire or theft, and collision and comprehensive coverage on motor vehicles and other property pledged as security on this Loan.

• Must (i) be in an amount and type sufficient to repair the collateral to its existing condition prior to the loss, and/or to replace the collateral with comparable or like property, minus depreciation, if it is damaged or lost; or (ii) be in an amount and type as we might otherwise inform you that we require.

• Must have a maximum deductible as set forth by us.

• Must be maintained in force for as long as the loan is outstanding.

• Must name us as loss payee. We must receive the loss payee endorsement within 30 days of your loan date.

These requirements are solely in our discretion and we may change any of these requirements at any time for any reason. The insurance may be obtained by any insurer of your choice that is acceptable to us.

(b) Lender-placed property insurance. Please read carefully:

• If you fail to maintain insurance satisfying the requirements set forth above, or if you fail to provide us proof of such coverage, we may, but do not have to, obtain insurance to protect our interest (not yours) in the property.

• The total cost of lender-placed insurance will be added to the loan balance. The total cost of this insurance includes, but is not limited to, the premium, any administrative costs we incur, any commissions that may be earned, and other reasonable expenses related to your failure to maintain insurance. This cost will be paid by you either on demand, or by increasing your periodic payment, or by extending the loan term.

• Whether we obtain insurance, and the amount and types of coverage that we may obtain, is solely in our discretion. We may obtain this insurance from anyone we want, including an affiliate of ours, and such affiliate may earn a commission on the coverage.

• The insurance placed by us is without benefit to you personally, and is primarily for our protection. It may not adequately protect your interest in the collateral or any personal property contained in the collateral, and will not satisfy any mandatory liability or financial responsibility requirements under state law.

• Coverage obtained by us may be considerably more expensive than coverage you could obtain on your own and may be different than previous policies you may have had or policies that you may prefer.

• Any insurance placed by us will be effective as of the date your policy lapsed or, if you never obtained insurance, the date of the loan.

• Nothing in this agreement is intended to confer third-party beneficiary rights or status to you with respect to any agreements between us and our insurer or its agent.

(c) How to remove lender-placed property insurance. You may have the lender-placed coverage cancelled at any time by providing evidence to us that you have purchased insurance coverage satisfying the requirements set forth above. If you do so, you will receive a refund of any unearned premiums and finance charges on the lender-placed coverages and your loan balance will be adjusted accordingly.

(d) Other. You assign us the right to receive and endorse any insurance proceeds check, to apply those proceeds to the sums you owe, and you direct any insurer to pay those proceeds directly to us. You further authorize us or our representative to obtain the necessary information for verification of adequate coverage. We, or our affiliates, may receive compensation or reimbursement of expenses related to any insurance premiums added by us.

(e) Default. If you fail to maintain insurance as set forth above, you will be in default of your loan. We may either place our own insurance on the collateral as explained above, or we can declare you in default and take all remedies set forth in your loan or security agreement or available to us under applicable law, including calling the loan immediately due.

Contact Information:

People Driven Credit Union

24333 Lahser Rd

Southfield, MI 48033

844-700-PDCU (7328)

Contact Us