-

Overview

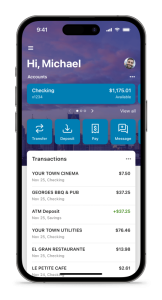

Take command of your account at home.

Automate your life in the comfort of your own home with mobile banking.

Our free mobile banking service has all the great features you expect from online banking, conveniently available from your smartphone, tablet, or Kindle®! Check balances, make transfers, find ATMs, and more! It’s like having your credit union in your purse or pocket.

Download the free PDCU Mobile App in your device’s app store.

You can also use mobile banking to receive eAlerts by phone or email.

View a helpful tutorial video on how to set up eAlerts.

MyPDCU Credit Score & Score Simulator

MyPDCU Credit Score & Score Simulator is a revolutionary service designed to demystify credit scores and empower our members to take control of their financial health. This free feature, integrated seamlessly into our online and mobile banking platforms, provides a comprehensive suite of tools to help members understand, monitor, and improve their credit scores.

About MyPDCU Credit Score & Score Simulator

MyPDCU App Features:

- Transfer funds between accounts

- Find ATM locations

- Check account balances instantly

- Make loan payments

- View and print copies of paid checks

- Send money safely to anyone in the United States

- Schedule one-time, recurring, or future bill payments – free!

Pay family, Friends, anytime, anywhere with mobile banking.

Need to pay for the lawn service? Is your niece selling Girl Scout cookies, and you want to pay your sister for the order? Transfer and receive funds on any device to anyone you want. Use our BillPay service to send money Person-to-Person for free! Learn how to use our free Person-to-Person transfers.

Download the MyPDCU Mobile App

Deposit Checks from Your Phone

Have a check but not near a branch? No problem. Use mobile banking to deposit your checks directly through the PDCU app, up to $2,500 daily!

-

FAQs

Frequently Asked Questions

To transfer money from one account to another within the MyPDCU mobile/online banking experience, follow these steps:

- Open the MyPDCU app or visit my.peopledrivencu.org and log in.

- Click the "Transfer" button.

- Select which of your accounts you wish to transfer money from.

- Select which account you wish to transfer money to.

- Type in the amount you wish to transfer.

- Once you click submit, the transaction will be placed, there is no other confirmation required.

- Once you see the green checkmark, you can click on "done," or "Make another transfer."

To log out of the MyPDCU app or online banking, follow these steps.

- Use the menu bar in the upper left-hand corner of the MyPDCU app or online banking.

- At the bottom of the menu bar, open the "^" popup next to your profile name.

- Click on "Sign out."

Gone are the days when you had to visit a branch to deposit your checks. With People Driven Credit Union’s mobile check deposit service, managing your finances becomes a breeze. This technology, known as remote deposit capture, lets you deposit checks from anywhere by simply snapping a picture with your device.

How Mobile Check Deposit Works:

- Set the Stage: Place your check against a dark background to ensure all details are captured clearly due to the contrast.

- Sign and Specify: Endorse the back of the check and write “For Mobile Deposit Only to PDCU” along with your clear signature and account number to streamline processing.

- Open the MyPDCU App: Log in and select "Deposits."

- Enter the Check Details: Enter the check amount and select the account where you want to deposit it.

- Capture the Check Images: Place the front of the check within the phone's frame and tap the screen to capture an image. Repeat for the back of the check.

- Verify the Deposit: Check your transaction history in the app to ensure the deposit was successful.

- Secure Disposal: After confirming the deposit, cut up the check to secure your personal information. Dispose of the pieces separately.

The check will be deposited into the requested account and become available according to our standard check processing timeline. Past deposits can be viewed in the app.

For additional details, please visit our website at peopledrivencu.org/amazing or contact us if you have questions.

Embrace simplicity and security with our digital banking solutions. At People Driven Credit Union, we're here to make your financial management effortless.

No! Bill pay is free to use, unless you submit a rush payment or choose the option to send a gift payment. Costs of these will be shown before submitting.To make a mobile deposit to your PDCU account using your smartphone, log into your MyPDCU app or the MyPDCU online banking portal and click on "Deposit." Enter the check amount, click "Continue," and select which of your accounts (if you have more than one) you want to make the deposit to. Sign your check, write "For Mobile Deposit Only at PDCU", and include your PDCU account number. Follow the instructions provided in the app to capture an image of the front and back of the check.

Anything deposited over $2,500 will be reviewed by the credit union and will not show in your account right away. Check limit is $25,000. All deposits are subject to holds.

Securely store the original check for 7 business days after the deposit. Verify you check has been credited to your account. After 7 business days, destroy the original check by marking it "VOID" and shredding it.

YES! Depending on your browser, once you have opened your statement you may see icons on the top corner for downloading and printing. You may also right click on your mouse and choose ‘save as’ or ‘print’.We suggest using a password only you would know. Do not save any passwords on devices that are not yours. Use facial recognition or thumbprint recognition on your private devices.There are several convenient ways to make a payment on your People Driven Visa Credit Card:

- Online: Log into online banking, select "Transfer," choose the account you're transferring from, and select your Visa card as the transfer destination. You can also set up automatic payments to ensure you never miss a due date.

- Mobile App: Make payments directly through the PDCU mobile app.

- By Phone: Call 844-700-7328 to make a payment with a debit card or have a representative transfer a payment from your PDCU savings or checking account.

- By Mail: You can mail your payment to:

- People Driven Credit Union 24333 Lahser Rd Southfield, MI 48033

- Or to PO BOX 984 Southfield, MI 48037

- In Person: Visit any PDCU branch to make your payment in person.

Setting up automatic payments will ensure you never miss a due date, and you can change the frequency to suit your needs.

When preparing your tax return, you are asked to include the amounts of interest earned on your accounts. If your account earned $10 or more in the calendar year, a 1099-INT will be issued. 1099-INTs are typically mailed to you by the end of January in the new year. You can also access this in online banking; click the E-statement tab and choose ‘Tax statements.’Bill Pay is a secure electronic service within online banking that allows members to pay bills without having to write checks or sign onto a vendor site to submit an electronic payment. Online bill payment is tied to your PDCU checking account from which funds are withdrawn electronically or via share draft for payment of one-time or recurring bills.

Mobile banking - It's like having a PDCU branch in your pocket.

Mobile banking gives you easy access to manage your money—anytime, anywhere.

Never wait in line again, with mobile banking

Download our Mobile App