Celebrate Life’s Next Big Step with a Graduation Loan

Graduation is an exciting time full of new beginnings — but it can also come with big expenses. Whether you’re preparing for job interviews, moving into a new place, or celebrating your achievement with family and friends, People Driven Credit Union (PDCU) is here to help with our Graduation Loan. Designed to provide quick, affordable funding, our Graduation Loan helps you manage the costs of celebrating your success and setting yourself up for the future.

|

For current members in good standing with a minimum direct deposit of $1,000 monthly for at least six consecutive months: |

For nonmembers or members without a minimum direct deposit of $1,000 monthly for at least six consecutive months: |

What Can a Graduation Loan Help Cover?

- Graduation ceremony expenses

- Cap and gown, announcements, and senior photos

- Travel costs for family celebrations

- Moving expenses for a new job or college

- Interview clothing and professional supplies

- Tuition balances or exam fees

Wherever your next steps lead, a Graduation Loan can help you start your journey.

Loan Details

The Graduation Loan is available for amounts up to $2,000 with an interest rate of 9.99%.

- Loan Amount: $500 – $1,000 → 9-month term, max 28.018% APR*

- Loan Amount: $1,001 – $1,500 → 12-month term, max 16.778% APR*

- Loan Amount: $1,501 – $2,000 → 18-month term, max 12.310% APR*

With an interest rate of just 9.99%, a maximum Annual Percentage Rate (APR) of 28.018% APR* and a $35 processing fee, this loan offers a low-cost solution to handle everything you need to celebrate graduation. Whether you need a smaller loan or a larger one, PDCU is here to help with flexible terms that fit your financial situation.

Who Can Apply?

This loan is available to qualifying PDCU members through our PD Quick Cash service. If you’re a member in good standing with a minimum direct deposit of $1,000 monthly for at least six consecutive months and need financial relief during your (or someone else’s) graduation, this is a great option for you!

If you don’t meet the criteria for the Graduation Loan, you can still apply for a regular personal loan to help cover your expenses.

Availability: The Graduation Loan is available from May 5th through June 30th, 2025, so make sure to apply before the deadline to take advantage of this offer.

Why Choose PDCU’s Graduation Loan?

Affordable: With an APR* as low as 13.617% and a $35 processing fee, this loan provides a way to cover expenses without adding to your financial burden.

Flexible Terms: With different loan amounts and repayment terms, you can select the option that best fits your financial situation and pay it off in manageable monthly payments.

Quick Access: Through PD Quick Cash, you can gain quick access4 to the funds you need, helping you manage your graduation and transition smoothly.

Personalized Support: As a member of PDCU, you have access to personalized support from our friendly team, who are ready to assist you throughout the loan process and beyond.

TruStage™ Payment Guard Insurance

With a PD Quick Cash Graduation Loan from People Driven Credit Union, you don’t just get fast access to funds—you also get free loan insurance! Our PD Quick Cash Graduation Loans now come with TruStage™ Payment Guard Loan Insurance, automatically included at no additional cost to you.

In the event of a covered job loss, TruStage™ Payment Guard Insurance provides a lump sum payment of $500 toward your loan balance, helping to ease your financial burden during challenging times. Stay protected and secure your financial future with a PD Quick Cash Graduation Loan and TruStage™ Payment Guard Insurance.

How to Apply

Applying for a Graduation Loan is easy! Simply visit PDCU’s online application (Starts May 5, 2025) page or stop by one of our branches to get started. If you’re already a member and meet the qualifying criteria, you can quickly apply and receive the funds you need to handle your graduation-related expenses.

|

For current members in good standing with a minimum direct deposit of $1,000 monthly for at least six consecutive months: |

For nonmembers or members without a minimum direct deposit of $1,000 monthly for at least six consecutive months: |

$2,000 Loan Terms:

For a Graduation Loan of $2,000 paid off over 18 months:

| Amount Financed: | $2,000.00 |

| Processing Fee: | $35.00 |

| Payment Guard Insurance: | Free |

| Interest Rate: | 9.99% |

| APR*: | 13.617% |

| Payment Every Month: | $120.10 |

| Total # of Payments: | 18 |

| Total Interest: | $161.89 |

| Total of Payments: | $2,161.89 |

Frequently Asked Questions

- The 2025 Summertime PD Quick Cash Loan application is now closed.

- For the Summertime Cash Loan, visit Personal Loan Options You can also call us at (248) 263-4100 for assistance.

- Quick Cash Loan: No credit check is required.

- Summertime Cash Loan: Yes, standard credit review applies and may affect your interest rate and approval amount.

- Quick Cash Loan: Funds may be deposited into your account within minutes after approval.

- Summertime Cash Loan: Typically funded within 5 business days upon final approval and document signing.

- PD Quick Cash Summertime Loan: Up to $2,000, 9.99% interest rate, no credit check, $35 fee, available only to current members with qualifying direct deposit.

- PDCU Summertime Cash Loan: Up to $30,000, available to both members and non-members, with credit and membership approval.

Follow these steps to enable email notifications:

- Open the Mail app on your iPhone.

- To receive notifications about replies to emails or threads:

- When reading an email: Tap the left arrow and tap Notify Me.

- When writing an email: Tap the Subject field, tap the blue bell in the subject field, and then tap Notify Me.

- To adjust how notifications appear:

- Go to Settings > Apps > Mail > Notifications, then turn on Allow Notifications.

- To customize notification settings for your email account:

- Go to Settings > Apps > Mail.

- Tap Notifications and ensure Allow Notifications is turned on.

- Tap Customize Notifications and choose the settings you want for your email account (e.g., Alerts or Badges).

- You can also adjust alert tones or ringtones if you turn on Alerts.

Some members using Apple devices have reported being kicked out of the app when retrieving the security code sent to their email during the PD Quick Cash Loan application process. This happens when members leave the app to check their email for the code, which causes the app to restart. This issue doesn’t seem to affect Android devices.

To avoid being kicked out of the application process, read How can I avoid being kicked out of the app when I receive the security code?

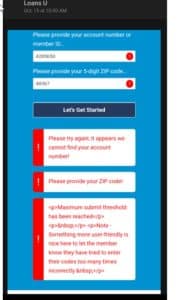

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.The origination fee for a PD Quick Cash loan is a one-time cost for convenience and speed. It allows you to secure funds instantly without a traditional credit check. This is particularly beneficial when you need urgent access to funds without the usual wait times or paperwork involved in standard loan processing. It's designed to be a fast, straightforward solution for immediate financial needs.

A one-time $35 processing fee applies, regardless of loan amount.

Disclosures

PD Quick Cash Graduation Loan Special Qualifications

*APR = Annual Percentage Rate. The PD Quick Cash Graduation Loan Special runs from May 5th through June 30th, 2025, with a Maximum Annual Percentage Rate (APR) of 28.018%. Members in good standing who receive monthly direct deposits can borrow up to $2,000 (loan amount determined by the total average of the member’s aggregate monthly deposits), with one loan allowed per Social Security number. For a $2,000 loan, the monthly payment is $120.10.

New and current members who do not meet the direct deposit criteria are welcome to apply for a regular personal loan. There is no prepayment penalty for this loan. To qualify, borrowers must be the primary account holder, in good standing with PDCU, have a valid email and physical address, and be current on all PDCU accounts for the last 90 days. Applicants must be at least 18 years old, and joint, business, trustee, conservatorship, and minor accounts are not eligible for this loan. The actual APR and loan term is subject to approval and may be determined upon the borrower’s creditworthiness and the amount borrowed. Rates are effective as of today and are subject to change.

4Important Information About PD Quick Cash

The PD Summertime Quick Cash Loan is available only to members in good standing with a qualifying direct deposit of at least $1,000/month for six consecutive months. $35 processing fee applies. No credit check is performed for this loan option.

Members are permitted to have up to two PD Quick Cash Loans simultaneously; however, a 30-day waiting period is required between loan applications. Members are only allowed three PD Quick Cash Loan products (open or closed) in a rolling six months. Maximum of two loans at a time.

“Same-day approval,” “under 60 seconds,” and “funds promptly” refer to the average time it takes to process applications for eligible members during regular business hours. Actual approval and funding times may vary based on application volume, account verification, and other eligibility requirements.

Approval is not guaranteed and is subject to credit union membership, account history, and other underwriting criteria. Applicants must be a member in good standing for a minimum of 180 days and meet eligibility criteria, which may include regular direct deposit and no recent loan delinquencies.

All loans are subject to credit union approval and other terms and conditions. People Driven Credit Union reserves the right to modify or discontinue this product at any time without notice.