Credit card balances remain near record highs in 2026, with national average interest rates still exceeding 20% APR. For many households, that means hundreds of dollars each month going toward interest alone, while balances barely decrease. Rising costs of living have only made it harder for families to keep up, leaving many searching for relief.

That’s why debt consolidation is a hot topic this year. Members are asking: Is it worth it to roll multiple debts into one loan? Will it actually save me money, or shift the problem?

In this post, we’ll explore how debt consolidation works, what types of debt you can and cannot consolidate, how to calculate your potential savings, and the options available through People Driven Credit Union including our partnership with GreenPath Financial Wellness. By the end, you’ll know whether debt consolidation makes sense for your financial situation in 2026.

What Is Debt Consolidation?

At its core, debt consolidation involves taking out a single new loan to pay off multiple existing debts. Instead of juggling numerous balances, due dates, and interest rates, you consolidate them into a single loan with a single monthly payment.

The purpose of debt consolidation is threefold:

- Simplify repayment – Managing one payment is easier than keeping track of multiple payments.

- Lower interest – If your new loan has a lower APR than your credit cards or other debts, more of your payment goes toward principal.

- Shorten your payoff timeline – With a structured repayment schedule, you can see a clear end date instead of making minimum payments indefinitely.

The most common debts consolidated into one loan include:

- High-interest credit card balances

- Medical bills

- Retail or department store cards

- Some unsecured personal loans

For many members, debt consolidation provides clarity and control consolidating scattered, high-interest debts into a single, predictable payment.

Why Debt Consolidation Matters in 2026

For many families, 2026 continues to be one of the most challenging financial years in recent memory. Rising costs for essentials, such as housing, groceries, and utilities, are squeezing household budgets, while debt levels continue to increase. According to national reports, the average credit card APR has climbed above 20%, with many cards charging even higher rates. At those levels, minimum payments often cover little more than interest making it feel nearly impossible to pay down balances.

Credit unions, however, continue to provide more affordable lending options. At People Driven Credit Union, members can explore Unsecured Personal Loans with rates as low as 10.54% APR¹ or Fixed Term Home Equity Loans starting at 6.75% APR*. For members carrying large balances at credit card rates above 20%, the difference in interest costs can be significant.

That’s why more members are asking about debt consolidation in 2026. They’re seeking a way to simplify their finances, reduce interest payments, and regain control over their financial future. Debt consolidation isn’t a cure-all, but in the right circumstances, it can be a powerful tool for creating breathing room in a tight budget.

What Debt Can (and Cannot) Be Consolidated

Debt consolidation is flexible, but it doesn’t apply to every type of debt. Knowing what you can and cannot consolidate is an essential first step before deciding if this strategy is right for you.

Debts you can typically consolidate include:

- Credit card balances – High-interest revolving debt is the most common target for consolidation.

- Medical bills – Hospital or doctor balances can often be rolled into a single loan.

- Retail or department store cards – These usually carry high APRs and can be simplified through consolidation.

- Unsecured personal loans – Smaller loans with higher rates may be combined into one lower-rate loan.

Debts you generally cannot consolidate include:

- Federal student loans – These are handled through specific federal repayment and consolidation programs, not through a credit union loan.

- Mortgages – Already secured by your home and not eligible for traditional debt consolidation.

- Auto loans – Already secured by the vehicle and not typically rolled into a consolidation loan.

- Certain tax debts or legal judgments – These may require separate repayment arrangements.

If most of your debt consists of high-interest credit cards, medical bills, or unsecured loans, debt consolidation could be a strong option. However, if your debt is tied to mortgages, student loans, or secured auto loans, other repayment strategies may be more suitable.

Qualifying for a Debt Consolidation Loan

Not everyone who applies for a debt consolidation loan will qualify for the best rates. Lenders look at several key factors when reviewing applications. Here’s what you should know before applying:

Credit Score

Aim for a credit score of 650 or higher to secure more favorable loan terms. Members with lower scores may still qualify, but rates could be higher.

Debt-to-Income (DTI) Ratio

Maintaining a DTI below 40% increases your chances of approval. This ratio compares your monthly debt payments to your gross monthly income, providing lenders with a snapshot of your financial capacity for new credit.

Income Stability

Lenders value steady, reliable income. Having consistent paychecks, or multiple streams of income, shows that you can handle monthly loan payments.

Employment History

If you’ve been with the same employer for more than two years, your chances of approval improve. A stable work history demonstrates reliability.

Debt Management Program Alternative

If your credit score or income stability doesn’t meet loan requirements, consider a program like the GreenPath Debt Management Program. It offers structured repayment support, works directly with your creditors, and doesn’t require high credit or collateral to get started.

By knowing what lenders look for, and by using tools like PDCU’s Credit Score & Simulator, you’ll be better prepared to qualify for a debt consolidation loan and secure the terms that make consolidation worth it.

-

- Related resource: Tips for Obtaining a Personal Loan with Bad Credit

- Related resource: How to Understand and Improve Your Credit Score

- Related resource: Improve Your Credit Score with Credit Goals

- Related resource: MyPDCU Credit Score & Score Simulator

Real-World Scenarios

It’s one thing to talk about interest rates in theory, it’s another to see how debt consolidation can actually change a member’s monthly payments. Let’s look at an example.

Meet Sarah: She has $10,000 in credit card debt spread across three cards with an average APR of 22%. Her minimum monthly payments total around $263, but most of that goes toward interest. At this pace, she’ll be paying for years without making much progress on the balance.

Now, let’s see what happens if Sarah consolidates her debt through People Driven Credit Union:

Unsecured Personal Loan at 10.49% APR¹

- Monthly payment per $1,000: $21.49

- Monthly payment on $10,000: $214.90

- Savings compared to her credit cards: nearly $50/month

Fixed Term Home Equity Loan at 7.19% APR*

- Monthly payment per $1,000: $19.89

- Monthly payment on $10,000: $198.90

- Savings compared to her credit cards: over $60/month

By consolidating, Sarah not only saves money each month but also gets a fixed payoff date, no more endless cycle of minimum payments.

Disclaimer: The payment examples above are based on rates available as of September 3, 2025, and are provided for illustrative purposes only. Actual rates, terms, and payments may differ based on your creditworthiness, loan type, and current market conditions. Please check with People Driven Credit Union for today’s rates.

How to Calculate Your Savings

Wondering if debt consolidation would actually save you money? Here’s a simple process you can use at home to get a clear picture.

Step 1: List all your debts.

Write down each debt you have, credit cards, medical bills, or unsecured loans. Note the balance, APR, and current minimum monthly payment for each.

Step 2: Add up your current monthly payments.

This gives you a baseline of how much you’re paying each month to keep up with your debts. Don’t be surprised if the total feels overwhelming, many members find they’re paying hundreds of dollars just in interest.

Step 3: Add up your current interest rates.

For example:

- Card A: $4,000 at 22% APR

- Card B: $3,500 at 21% APR

- Card C: $2,500 at 24% APR

Together, that’s $10,000 at an average rate of about 22%.

Step 4: Compare with a consolidation loan.

Here’s a comparison that shows how moving $10,000 of credit card debt to a Personal Loan or Fixed Term Home Equity Loan could help you save:

| Loan Type | APR* | Monthly Payment (per $1,000) |

|---|---|---|

| Average Credit Card | 20.00% |

Payment Example: Monthly payments of $26.34 for each $1,000 borrowed at 20.00% APR* for 60 months. |

| PDCU Unsecured Personal Loan | 10.54%¹ |

10.54%

|

| PDCU Fixed Term Home Equity Loan | 6.75% |

6.75%

|

¹Take advantage of a 0.25% discount when you enroll in autopay, already factored into the “as low as” rate. This discount applies to those who set up automatic payments from a People Driven Credit Union checking or savings account.

*APR = Annual Percentage Rate. The actual APR and loan term are subject to approval and may be determined based on the borrower’s creditworthiness, the amount borrowed, and the type, value, age, and condition of the collateral offered to secure the loan. Rates are effective as of today and are subject to change.

Step 5: Estimate your savings.

Multiply the new payment by your total balance, then compare it to what you’re paying now. That difference is your potential savings every month — and over the life of the loan, it can add up to thousands.

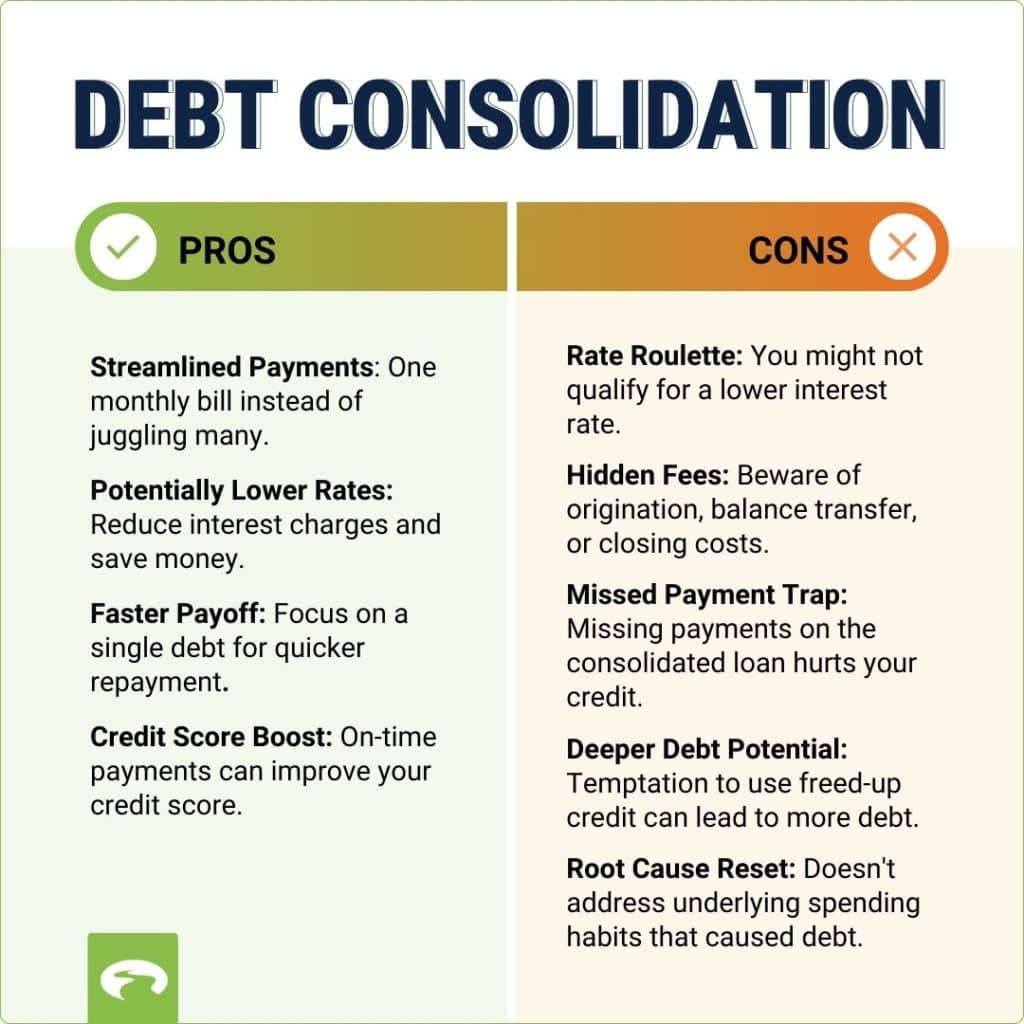

Pros and Cons

Pros of Debt Consolidation

Debt consolidation isn’t a magic solution, but when used wisely, it can offer some powerful advantages.

- Simplified Finances

Instead of juggling multiple bills, due dates, and interest rates, you’ll have just one predictable monthly payment. That makes it easier to budget and reduces the stress of managing scattered debts. - Lower Interest Rates

If your current debts are sitting on credit cards at 20% or higher, moving them into a lower-rate loan could save you hundreds (or even thousands) in interest costs over the life of the loan. - Predictable Payoff Date

Credit cards can feel like an endless cycle of minimum payments. With a fixed-term loan, you’ll know exactly when your balance will be paid off. - Credit Score Benefits

Paying off high-interest credit cards can improve your credit utilization ratio. Making consistent, on-time payments on your new loan, combined with this, may help improve your credit score over time. - A Path Forward

Perhaps the most significant benefit is the relief that comes from finally seeing a clear path forward. Many members find that once they consolidate their finances, they feel less overwhelmed and more in control of their financial future.

The Cons of Debt Consolidation

While debt consolidation can be a smart strategy, it may not be the right fit for everyone. Before you move forward, consider these potential drawbacks:

- Not Everyone Qualifies for Lower Rates

The best rates are typically offered to borrowers with strong credit histories. If your score is low, the loan you qualify for may not save you much compared to your current debts. - It Doesn’t Solve Spending Habits

Consolidation helps with existing balances, but it doesn’t prevent new debt from accumulating. If you continue to use your credit cards without a repayment plan, you could end up owing more than you started with. - Possible Fees or Costs

Some consolidation loans come with origination fees, and Home Equity Loans may involve closing costs for appraisals, title work, or processing. These expenses should be taken into account when making your decision. - Secured vs. Unsecured Risks

Using a Home Equity Loan to consolidate debt often means putting your house up as collateral. While this usually brings a lower rate, it also carries more risk if you fall behind on payments. - Longer Repayment Terms

Lower monthly payments may sound appealing, but stretching debt over a longer term could increase the total amount of interest you pay.

Debt consolidation is most effective when paired with discipline, a clear repayment plan, and a commitment to avoid adding new balances.

Debt Consolidation Options at PDCU

At People Driven Credit Union, we know that every member’s financial situation is unique. That’s why we offer multiple solutions to help you consolidate debt, lower your interest costs, and simplify your payments.

Unsecured Personal Loans

- Rates as low as 10.54%¹ APR*

- No collateral required

- Fixed monthly payments for a set term

- Great option if you want a straightforward, flexible loan that doesn’t tie up your home or other assets

Learn more about Personal Loans

Fixed Term Home Equity Loans

- Rates as low as 6.75% APR*

- Uses the equity in your home as collateral

- May involve closing costs (such as appraisal, title work, and processing)

- Best for members with significant debt or large balances who want the lowest possible interest rate

Learn more about Home Equity Loans

GreenPath Debt Management Program

- Free financial counseling is available to all PDCU members

- GreenPath works directly with your creditors to potentially lower rates and set up a structured repayment plan

- Ideal if you don’t qualify for a consolidation loan or want professional guidance to get back on track

- Provides budgeting support, debt payoff strategies, and long-term financial education

By offering both loan products and access to GreenPath, PDCU ensures members have the tools and support they need to choose the best path forward. Whether you prefer the control of a fixed loan or the structure of a guided repayment plan, we’re here to help you make it happen.

Frequently Asked Questions

Q: Does debt consolidation hurt my credit?

A: Applying for a new loan may result in a small, temporary dip in your credit score. Over time, making consistent on-time payments can actually improve your credit health.

Q: What types of debt can I consolidate?

A: Most unsecured debt can be consolidated, including credit card balances, medical bills, and certain personal loans. Home Equity Loans can also be used to consolidate debt if you own your home.

Q: Is a Personal Loan or a Home Equity Loan better for debt consolidation?

A: It depends. Personal Loans are unsecured and don’t require collateral, but typically have higher rates than Home Equity Loans. Home Equity Loans often have lower rates but require you to use your home as collateral and may involve closing costs.

Q: Can I still use my credit cards after consolidating?

A: Yes, but it’s best to avoid adding new balances while paying down your consolidated loan. Otherwise, you may end up in more debt than you started with.

Q: How do I know if debt consolidation is right for me?

A: If your current debts have high interest rates, and you’re ready to commit to repayment, consolidation may save you money and stress. A PDCU loan officer can walk you through your numbers and options.

Final Thought

A Debt Consolidation Loan isn’t a one-size-fits-all solution, but in 2026, it can be a powerful tool for the right member. By moving high-interest debt into a lower-rate loan, you can simplify your payments, reduce interest costs, and see a clear path to becoming debt-free. Pair that with smart budgeting and discipline, and debt consolidation can bring real peace of mind.

At People Driven Credit Union, we’re here to help you explore your options. Whether it’s an Unsecured Personal Loan, a Fixed Term Home Equity Loan, or working with GreenPath Financial Wellness, our team will walk you through the numbers and guide you to the solution that makes sense for your life.

Take the next step: Contact People Driven Credit Union today to schedule a free consultation and see how much you could save by consolidating your debt.

¹APR = Annual Percentage Rate. Loan rates, terms, and conditions are subject to credit approval and may vary based on creditworthiness, loan amount, and collateral (when applicable). Rates mentioned in this article are examples based on information available as of September 3, 2025, and may not reflect current rates. Actual rates are subject to change without notice. Payment examples provided are for illustrative purposes only. Additional fees may apply for Home Equity Loans, including credit report, property valuation, title work, flood search, tax tracking, mortgage recording, processing, and closing costs. Please contact People Driven Credit Union directly to confirm today’s rates and terms.