16-month CD

A 16-month CD (Certificate of Deposit) is a type of savings account offered by banks and credit unions. Here are the key characteristics:

- Fixed Term: It has a maturity period of nine months, during which the deposited money is locked in.

- Interest Rate: Typically offers a fixed interest rate generally higher than regular savings accounts.

- Minimum Deposit: Often requires a minimum deposit amount to open the account.

- Early Withdrawal Penalty: If you withdraw the funds before the 16-month term ends, you usually incur a penalty, a portion of the interest earned, or a specified fee.

- FDIC Insured: In the United States, CDs from credit unions are usually insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor per credit union.

A 16-month CD can be a good option if you have a specific short-term savings goal and want to earn a higher interest rate without taking on much risk.

A 16-month CD works as follows:

- Opening the CD: You deposit a lump sum of money into the CD account. The amount often needs to meet the bank or credit union’s minimum deposit requirement.

- Fixed Term: The money is committed to the CD for a fixed term of nine months. During this period, you cannot add to or withdraw from the principal amount without incurring penalties.

- Interest Rate: The bank or credit union pays you a fixed interest rate on the deposited amount for the entire term. This rate is usually higher than that of a regular savings account because the bank can use your money for a predictable period.

- Interest Accumulation: Interest is typically compounded and credited to your account at regular intervals, such as monthly or quarterly.

- Maturity: At the end of the 16-month term, the CD matures. You then have a few options:

- Withdraw the funds: You can take out your initial deposit plus the interest earned.

- Renew the CD: You can roll over the funds into a new CD, either for the same term or a different one, possibly at a new interest rate.

- Transfer the funds: You can transfer the money to another account.

- Early Withdrawal Penalty: If you need to access the money before the 16-month term ends, you will likely face an early withdrawal penalty. This penalty varies by institution but generally involves forfeiting a portion of the interest earned.

- FDIC/NCUA Insurance: If the CD is held at a bank, it is insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor per bank. If held at a credit union, it is insured by the NCUA (National Credit Union Administration) with the same coverage limits.

A 16-month CD can be a suitable option for short-term savings goals, offering a balance between earning a higher interest rate and having your money tied up for a relatively short period.

Yes, your money is safe in a 16-month CD. At People Driven Credit Union, our CDs are insured by the NCUA (National Credit Union Administration) up to $250,000 per depositor.

Withdrawing money from a 16-month CD before the term ends typically incurs an early withdrawal penalty. At People Driven Credit Union, the Early Withdrawl Penalty is a Loss of 90 days of interest for withdrawing funds early.

APY stands for Annual Percentage Yield. It is a measure of the total amount of interest earned on an account based on the interest rate and the frequency of compounding over a year. APY is a useful metric for comparing the annual earnings on different savings products, such as savings accounts, CDs, and money market accounts, because it standardizes the effect of compounding.

Key Points About APY

- Includes Compounding: APY accounts for how often interest is compounded (e.g., daily, monthly, quarterly), which can significantly affect the total interest earned over time.

- Comparison Tool: APY provides a standard way to compare the annual interest earnings of different savings products, regardless of how frequently interest is compounded.

- Formula: The formula for calculating APY is:

APY = (1 + r/n)^n - 1

where r is the nominal interest rate (expressed as a decimal), and n is the number of compounding periods per year.

- Higher APY: A higher APY indicates that you will earn more interest on your money over a year, assuming the same principal amount.

Example

For example, if a savings account offers an interest rate of 5% compounded monthly, the APY would be higher than 5% due to the effect of monthly compounding. This makes APY a useful metric for comparing the real return on different financial products.

When you’re comparing savings accounts, CDs, or other financial products, you’ll often see two numbers: an interest rate (or dividend rate, if it’s a credit union account) and an Annual Percentage Yield (APY). At first glance, they might seem like the same thing—but they’re not. Knowing the difference helps you make smarter financial choices, whether you’re opening a savings account or making a long-term investment. Let’s break it down.

Interest Rate or Dividend Rate: the Base Number

Interest Rate

The interest rate is the basic percentage a bank or credit union uses to calculate how much you’ll pay on a loan or earn on a deposit, before considering how often interest is added (compounded).

Let’s say you open a credit union savings account with an interest rate of 3.00%. That’s the base rate your money earns before compounding is applied.

Dividend Rate

At a credit union, the term “dividend rate” is often used instead of “interest rate” for deposit accounts. As a member-owner, you’re technically receiving a share of the credit union’s earnings—similar to a dividend from a company. Functionally, though, the dividend rate works the same way as an interest rate on a bank account.

Annual Percentage: the Full Picture of Earnings or Costs

Annual Percentage Yield (APY)

APY shows how much you earn in a year on deposits, including the effects of compounding. Compounding is the process of earning interest on your interest (for deposits) or being charged interest on interest (for loans).

If your account compounds interest daily or monthly, you’ll earn a bit more than the base rate, because you start earning interest on the interest that’s already been added. That extra boost from compounding is why the APY is slightly higher than the interest/dividend rate.

Compounding Interest: Dividend Rate vs APY

APY provides a clearer picture of the actual annual earnings from savings accounts, money markets, and certificates because it includes compounding. For loans, APR is the more accurate number for comparing costs between offers, because it reflects compounding as well as fees.

- Interest Rate/Dividend Rate: If a savings account offers a 5% interest rate compounded monthly, the nominal rate is 5%. This is the base number for how much your balance will grow before compounding.

- APY: When considering the monthly compounding, the same account will have an APY slightly higher than 5% because the interest earned each month also earns interest in subsequent months.

Comparing Financial Offers Using APY

If you only look at the interest or dividend rate, you might think two products are equal—but differences in compounding or fees can make one clearly better for your wallet.

A savings account with a slightly lower rate but daily compounding could earn you more than one with a higher rate but annual compounding.

Interest Rate vs APY Example

Always use APY when comparing savings products from different institutions. Knowing the difference between the base rate and APY helps you see the full picture, allowing you to make confident choices—whether you’re saving for a big purchase or making long-term investments.

Let’s compare two savings accounts:

| Account | Dividend/

Interest Rate |

Compounding |

APY |

|

A |

3.00% | Annual | 3.00% |

| B | 3.00% | Monthly |

3.04% |

Both accounts have the same base rate, but because Account B compounds monthly, the APY is slightly higher. That’s the effect of compounding.

Let Us Help You With the Next Big Stage of Your Life

At People Driven Credit Union, we’re dedicated to helping you achieve your financial goals. As a member-owned financial institution, we’re literally invested in your future—and stand behind our commitment to transparency, security, and service excellence.

Become a member and open an account today!

1. How often are dividends compounded?

Dividends on savings, money market accounts, and certificates are typically compounded and credited monthly unless otherwise stated in the account disclosure. Compounding helps your balance grow by earning dividends on previously earned dividends.

2. Why is the APY higher than the dividend rate on a certificate?

The dividend rate is the base rate used to calculate earnings. APY shows what you actually earn over a year, including compounding. Because dividends are compounded, the APY is slightly higher than the dividend rate.

3. What is the difference between APY and APR?

APY applies to deposit accounts and shows how much you earn in a year. APR applies to loans and shows the total yearly cost of borrowing, including certain fees. Use APY when comparing savings products and APR when comparing loans.

4. Does compounding frequency really make a difference?

Yes. The more often dividends are compounded, the sooner you begin earning dividends on previously earned dividends. Over time, even small differences can increase your total earnings.

5. When comparing accounts, should I look at the dividend rate or APY?

APY is the better number to compare. It reflects the total amount you can expect to earn over a year, including compounding, giving you a clearer picture of your true return.

9-month CD

APY stands for Annual Percentage Yield. It is a measure of the total amount of interest earned on an account based on the interest rate and the frequency of compounding over a year. APY is a useful metric for comparing the annual earnings on different savings products, such as savings accounts, CDs, and money market accounts, because it standardizes the effect of compounding.

Key Points About APY

- Includes Compounding: APY accounts for how often interest is compounded (e.g., daily, monthly, quarterly), which can significantly affect the total interest earned over time.

- Comparison Tool: APY provides a standard way to compare the annual interest earnings of different savings products, regardless of how frequently interest is compounded.

- Formula: The formula for calculating APY is:

APY = (1 + r/n)^n - 1

where r is the nominal interest rate (expressed as a decimal), and n is the number of compounding periods per year.

- Higher APY: A higher APY indicates that you will earn more interest on your money over a year, assuming the same principal amount.

Example

For example, if a savings account offers an interest rate of 5% compounded monthly, the APY would be higher than 5% due to the effect of monthly compounding. This makes APY a useful metric for comparing the real return on different financial products.

Withdrawing money from a 9-month CD before the term ends typically incurs an early withdrawal penalty. At People Driven Credit Union, the Early Withdrawl Penalty is a Loss of 90 days of interest for withdrawing funds early.

Yes, your money is safe in a 9-month CD. At People Driven Credit Union, our CDs are insured by the NCUA (National Credit Union Administration) up to $250,000 per depositor.

When you’re comparing savings accounts, CDs, or other financial products, you’ll often see two numbers: an interest rate (or dividend rate, if it’s a credit union account) and an Annual Percentage Yield (APY). At first glance, they might seem like the same thing—but they’re not. Knowing the difference helps you make smarter financial choices, whether you’re opening a savings account or making a long-term investment. Let’s break it down.

Interest Rate or Dividend Rate: the Base Number

Interest Rate

The interest rate is the basic percentage a bank or credit union uses to calculate how much you’ll pay on a loan or earn on a deposit, before considering how often interest is added (compounded).

Let’s say you open a credit union savings account with an interest rate of 3.00%. That’s the base rate your money earns before compounding is applied.

Dividend Rate

At a credit union, the term “dividend rate” is often used instead of “interest rate” for deposit accounts. As a member-owner, you’re technically receiving a share of the credit union’s earnings—similar to a dividend from a company. Functionally, though, the dividend rate works the same way as an interest rate on a bank account.

Annual Percentage: the Full Picture of Earnings or Costs

Annual Percentage Yield (APY)

APY shows how much you earn in a year on deposits, including the effects of compounding. Compounding is the process of earning interest on your interest (for deposits) or being charged interest on interest (for loans).

If your account compounds interest daily or monthly, you’ll earn a bit more than the base rate, because you start earning interest on the interest that’s already been added. That extra boost from compounding is why the APY is slightly higher than the interest/dividend rate.

Compounding Interest: Dividend Rate vs APY

APY provides a clearer picture of the actual annual earnings from savings accounts, money markets, and certificates because it includes compounding. For loans, APR is the more accurate number for comparing costs between offers, because it reflects compounding as well as fees.

- Interest Rate/Dividend Rate: If a savings account offers a 5% interest rate compounded monthly, the nominal rate is 5%. This is the base number for how much your balance will grow before compounding.

- APY: When considering the monthly compounding, the same account will have an APY slightly higher than 5% because the interest earned each month also earns interest in subsequent months.

Comparing Financial Offers Using APY

If you only look at the interest or dividend rate, you might think two products are equal—but differences in compounding or fees can make one clearly better for your wallet.

A savings account with a slightly lower rate but daily compounding could earn you more than one with a higher rate but annual compounding.

Interest Rate vs APY Example

Always use APY when comparing savings products from different institutions. Knowing the difference between the base rate and APY helps you see the full picture, allowing you to make confident choices—whether you’re saving for a big purchase or making long-term investments.

Let’s compare two savings accounts:

| Account | Dividend/

Interest Rate |

Compounding |

APY |

|

A |

3.00% | Annual | 3.00% |

| B | 3.00% | Monthly |

3.04% |

Both accounts have the same base rate, but because Account B compounds monthly, the APY is slightly higher. That’s the effect of compounding.

Let Us Help You With the Next Big Stage of Your Life

At People Driven Credit Union, we’re dedicated to helping you achieve your financial goals. As a member-owned financial institution, we’re literally invested in your future—and stand behind our commitment to transparency, security, and service excellence.

Become a member and open an account today!

1. How often are dividends compounded?

Dividends on savings, money market accounts, and certificates are typically compounded and credited monthly unless otherwise stated in the account disclosure. Compounding helps your balance grow by earning dividends on previously earned dividends.

2. Why is the APY higher than the dividend rate on a certificate?

The dividend rate is the base rate used to calculate earnings. APY shows what you actually earn over a year, including compounding. Because dividends are compounded, the APY is slightly higher than the dividend rate.

3. What is the difference between APY and APR?

APY applies to deposit accounts and shows how much you earn in a year. APR applies to loans and shows the total yearly cost of borrowing, including certain fees. Use APY when comparing savings products and APR when comparing loans.

4. Does compounding frequency really make a difference?

Yes. The more often dividends are compounded, the sooner you begin earning dividends on previously earned dividends. Over time, even small differences can increase your total earnings.

5. When comparing accounts, should I look at the dividend rate or APY?

APY is the better number to compare. It reflects the total amount you can expect to earn over a year, including compounding, giving you a clearer picture of your true return.

A 9-month CD works as follows:

- Opening the CD: You deposit a lump sum of money into the CD account. The amount often needs to meet the bank or credit union’s minimum deposit requirement.

- Fixed Term: The money is committed to the CD for a fixed term of nine months. During this period, you cannot add to or withdraw from the principal amount without incurring penalties.

- Interest Rate: The bank or credit union pays you a fixed interest rate on the deposited amount for the entire term. This rate is usually higher than that of a regular savings account because the bank can use your money for a predictable period.

- Interest Accumulation: Interest is typically compounded and credited to your account at regular intervals, such as monthly or quarterly.

- Maturity: At the end of the 9-month term, the CD matures. You then have a few options:

- Withdraw the funds: You can take out your initial deposit plus the interest earned.

- Renew the CD: You can roll over the funds into a new CD, either for the same term or a different one, possibly at a new interest rate.

- Transfer the funds: You can transfer the money to another account.

- Early Withdrawal Penalty: If you need to access the money before the 9-month term ends, you will likely face an early withdrawal penalty. This penalty varies by institution but generally involves forfeiting a portion of the interest earned.

- FDIC/NCUA Insurance: If the CD is held at a bank, it is insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor per bank. If held at a credit union, it is insured by the NCUA (National Credit Union Administration) with the same coverage limits.

A 9-month CD can be a suitable option for short-term savings goals, offering a balance between earning a higher interest rate and having your money tied up for a relatively short period.

A 9-month CD (Certificate of Deposit) is a type of savings account offered by banks and credit unions. Here are the key characteristics:

- Fixed Term: It has a maturity period of nine months, during which the deposited money is locked in.

- Interest Rate: Typically offers a fixed interest rate generally higher than regular savings accounts.

- Minimum Deposit: Often requires a minimum deposit amount to open the account.

- Early Withdrawal Penalty: If you withdraw the funds before the 9-month term ends, you usually incur a penalty, a portion of the interest earned, or a specified fee.

- FDIC Insured: In the United States, CDs from credit unions are usually insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor per credit union.

A 9-month CD can be a good option if you have a specific short-term savings goal and want to earn a higher interest rate without taking on much risk.

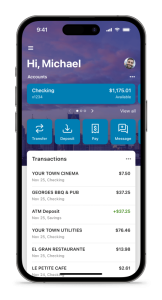

Accounts

You must be the child’s parent, grandparent, or legal guardian to open and manage an account. As the joint account holder, you’ll be able to set up account alerts, parental controls, online access and more.

It’s a bank account that can help your kids and teens learn to manage money. Our youth accounts come with both a checking and saving account where parents are able to set up alerts and limits. Plus, you can guide your child through real-world experiences like using an ATM. There’s a minimum of $5 for the first deposit – and no monthly service fee.

Our youth accounts are for ages 0-17.

A 16-month CD (Certificate of Deposit) is a type of savings account offered by banks and credit unions. Here are the key characteristics:

- Fixed Term: It has a maturity period of nine months, during which the deposited money is locked in.

- Interest Rate: Typically offers a fixed interest rate generally higher than regular savings accounts.

- Minimum Deposit: Often requires a minimum deposit amount to open the account.

- Early Withdrawal Penalty: If you withdraw the funds before the 16-month term ends, you usually incur a penalty, a portion of the interest earned, or a specified fee.

- FDIC Insured: In the United States, CDs from credit unions are usually insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor per credit union.

A 16-month CD can be a good option if you have a specific short-term savings goal and want to earn a higher interest rate without taking on much risk.

A 16-month CD works as follows:

- Opening the CD: You deposit a lump sum of money into the CD account. The amount often needs to meet the bank or credit union’s minimum deposit requirement.

- Fixed Term: The money is committed to the CD for a fixed term of nine months. During this period, you cannot add to or withdraw from the principal amount without incurring penalties.

- Interest Rate: The bank or credit union pays you a fixed interest rate on the deposited amount for the entire term. This rate is usually higher than that of a regular savings account because the bank can use your money for a predictable period.

- Interest Accumulation: Interest is typically compounded and credited to your account at regular intervals, such as monthly or quarterly.

- Maturity: At the end of the 16-month term, the CD matures. You then have a few options:

- Withdraw the funds: You can take out your initial deposit plus the interest earned.

- Renew the CD: You can roll over the funds into a new CD, either for the same term or a different one, possibly at a new interest rate.

- Transfer the funds: You can transfer the money to another account.

- Early Withdrawal Penalty: If you need to access the money before the 16-month term ends, you will likely face an early withdrawal penalty. This penalty varies by institution but generally involves forfeiting a portion of the interest earned.

- FDIC/NCUA Insurance: If the CD is held at a bank, it is insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor per bank. If held at a credit union, it is insured by the NCUA (National Credit Union Administration) with the same coverage limits.

A 16-month CD can be a suitable option for short-term savings goals, offering a balance between earning a higher interest rate and having your money tied up for a relatively short period.

Yes, your money is safe in a 16-month CD. At People Driven Credit Union, our CDs are insured by the NCUA (National Credit Union Administration) up to $250,000 per depositor.

Withdrawing money from a 16-month CD before the term ends typically incurs an early withdrawal penalty. At People Driven Credit Union, the Early Withdrawl Penalty is a Loss of 90 days of interest for withdrawing funds early.

APY stands for Annual Percentage Yield. It is a measure of the total amount of interest earned on an account based on the interest rate and the frequency of compounding over a year. APY is a useful metric for comparing the annual earnings on different savings products, such as savings accounts, CDs, and money market accounts, because it standardizes the effect of compounding.

Key Points About APY

- Includes Compounding: APY accounts for how often interest is compounded (e.g., daily, monthly, quarterly), which can significantly affect the total interest earned over time.

- Comparison Tool: APY provides a standard way to compare the annual interest earnings of different savings products, regardless of how frequently interest is compounded.

- Formula: The formula for calculating APY is:

APY = (1 + r/n)^n - 1

where r is the nominal interest rate (expressed as a decimal), and n is the number of compounding periods per year.

- Higher APY: A higher APY indicates that you will earn more interest on your money over a year, assuming the same principal amount.

Example

For example, if a savings account offers an interest rate of 5% compounded monthly, the APY would be higher than 5% due to the effect of monthly compounding. This makes APY a useful metric for comparing the real return on different financial products.

You will receive a notice in the mail 30 days before the maturity date of your CD.

Once the initial deposit has been made funds cannot be added to the CD until maturity. Once the CD matures you may add funds if you wish to renew the CD.

ACH Origination

Simply fill out the contact form below, and a PDCU Business Services representative will guide you through the setup process. You can also call us at (248) 263-4100 for assistance.

Yes. You can set up one-time or recurring payments to payees, making it easier to automate payroll, rent, or vendor payments.

PDCU’s ACH Origination includes multiple layers of security such as encrypted authentication, customizable user permissions, dual approval workflows, and automatic notifications for each ACH batch.

There’s no hard limit on the number of transactions you can initiate, but transaction volume and limits may be based on your account profile and risk review.

You can make a wide range of payments, including:

- Employee payroll

- Vendor and supplier payments

- Membership dues

- Interbank transfers

- State and Federal tax payments

ACH Origination is available to eligible People Driven Credit Union business members with an active business checking account. Our team will work with you to assess your needs and get you set up.

ACH Origination is a service that allows businesses to send and receive electronic payments through the Automated Clearing House (ACH) network. It’s commonly used for direct deposit, vendor payments, recurring billing, and tax remittances.

Nacha, short for the National Automated Clearing House Association, is the nonprofit organization that oversees the ACH (Automated Clearing House) network in the United States.

What Does Nacha Do?

- Manages the Rules: Nacha develops, maintains, and enforces the Nacha Operating Rules, which govern the processing of ACH payments and ensure consistency, security, and reliability across all financial institutions using the network.

- Ensures Security and Compliance: Nacha establishes standards for data security, risk management, and fraud prevention for organizations participating in ACH transactions.

- Promotes Innovation: Nacha works with banks, credit unions, and businesses to support new payment solutions, such as Same Day ACH and tools for faster settlement and improved access to electronic payments.

- Educates and Advocates: Nacha serves as an advocate for the ACH network, helping both financial institutions and the public understand how electronic payments work and why they’re secure and efficient.

In short, Nacha is the governing body behind the ACH network, ensuring it operates smoothly, safely, and in a way that benefits both consumers and businesses.

The Automated Clearing House (ACH) network is a secure, nationwide system that financial institutions use to transfer funds between bank accounts in the United States electronically. Managed by Nacha (National Automated Clearing House Association), the ACH network enables both credit and debit transactions, including:

- Direct deposits of payroll, Social Security, and tax refunds

- Automatic bill payments for utilities, mortgages, and loans

- Business-to-business payments

- Peer-to-peer money transfers

- Government and tax payments

ACH transactions are typically processed in batches, rather than instantly, like wire transfers, and often settle within one to two business days; however, same-day ACH is available in some cases.

It’s a cost-effective and efficient way for businesses and consumers to transfer money electronically, eliminating the need for checks or credit card networks.

Adjustable Rate Mortgage

Meet Our PDCU Mortgage Specialist

Michelle Dzon is authorized to act as an agent on behalf of People Driven Credit Union. Contact her for personalized assistance with your mortgage needs.

Michelle Dzon

Member First Mortgage

michelle.dzon@memberfirstmortgage.com

616-301-1714 | NMLS ID: #401292

Yes, many borrowers choose to refinance their ARM to a fixed-rate mortgage before the adjustable period begins to lock in a stable interest rate and predictable monthly payments.

Consider your financial situation, how long you plan to stay in the home, and your risk tolerance for potential interest rate changes. ARMs can be a good choice if you plan to sell or refinance before the adjustable period begins or expect interest rates to remain stable or decline.

Some ARMs may have prepayment penalties, but People Driven Credit Union does not. You can refinance or pay off your Adjustable Rate Mortgage with PDCU early without any prepayment penalties.

Yes, ARMs often have caps that limit how much the interest rate can increase at each adjustment period and over the life of the loan. These caps provide some protection against large payment increases.

ARM interest rates adjust based on a specific index (such as the Treasury index) plus a margin set by the lender. When the index rate changes, the interest rate on your loan adjusts accordingly.

The main risk with an ARM loan is that your monthly payments can increase if interest rates rise. Understanding the potential for payment changes is important to ensure that you can afford higher payments if the rate adjusts upward.

ARMs typically offer lower initial interest rates compared to fixed-rate mortgages, which can lead to lower initial monthly payments. This can be beneficial if you plan to sell or refinance before the adjustable period begins.

The initial period is when the interest rate on an ARM is fixed. After this period, the rate adjusts at regular intervals. For example, a 7/1 ARM has a fixed rate for the first seven years and then adjusts once every 12 months.

ARMs are often described with two numbers, such as 5/5, 7/1, or 10/1. The first number indicates the initial fixed-rate period (in years), and the second number indicates how often the rate will adjust after the initial period (in years).

ATV Loans

AutoPay is a convenient service that automatically withdraws your loan payment each month from your People Driven Credit Union checking or savings account. It helps you stay on track, avoid late fees, and may even qualify you for our ¹Special Loan Rate Discount.

To enroll in AutoPay, please call us at 248-263-4100 and a representative will assist you with setup.

Our ¹Special Loan Rate Discount offers a 0.25% APR reduction when you set up automatic payments (AutoPay) for your loan from a People Driven Credit Union checking or savings account. This discount is already included in the “as low as” rate advertised.

To enroll in AutoPay and receive the discount, please call us at 248-263-4100. A representative will assist you in setting up monthly automatic withdrawals from your PDCU account.

Note: The discount is available only for eligible loans with AutoPay set up from a PDCU account. Terms and conditions may apply.

Absolutely. We offer financing options for both new and pre-owned ATVs. Terms and rates may vary based on the vehicle’s condition and age.

Yes, our pre-approval process lets you know your borrowing power before you start shopping for your perfect ATV.

Our ATV loans cover a variety of all-terrain vehicles designed to enhance your off-road adventures, including, ATVs, UTVs (Utility Task Vehicles), side-by-sides (sxs) four-wheelers, quad bikes, recreational off-highway vehicles (ROVs), and multipurpose off-highway utility vehicle (MOHUV).

Have something in mind and wondering if PDCU will finance it? Call us as 248-463-4100.

Our application process often provides pre-approval decisions quickly, and final approval typically takes just a few days once all documentation is submitted.

Yes, enrolling in autopay may qualify you for a rate discount, reducing the overall cost of your loan. Check with our team for current promotional details.

A down payment may be needed, depending on your credit profile, the value of the vehicle or watercraft, and the specific loan structure. While not always required, a down payment can lower your monthly payments and the total amount of interest paid. Our representatives will guide you through the requirements. Call 248-263-4100 to speak with a PDCU loan officer.

Loan terms are flexible and can be tailored to fit your financial situation. At People Driven Credit Union, loan terms for recreational vehicles such as ATVs, motorcycles, boats, snowmobiles, and campers generally range from 12 to 180 months. Longer terms can lower monthly payments but may result in higher total interest paid.

Interest rates vary based on factors like your credit score, loan term, and the age of the vehicle or watercraft. People Driven Credit Union offers competitive rates to make financing accessible and affordable for our members. Call 248-263-4100 to speak with a PDCU loan officer about the loan rate you can expect.

Auto Loan Refinancing

Refinancing replaces your current auto loan with a new one—usually with a different lender—to secure a lower rate, adjust your monthly payment, or change your term. PDCU pays off your existing lender and you make payments to PDCU going forward.

Common reasons include: your credit score has improved, market rates have dropped, your original rate was high, you want a lower monthly payment, you want to pay off faster with a shorter term, or you need to add/remove a co-signer.

For the most current APRs, please visit our Loan Rates page. Terms are available up to 72 months for eligible vehicles. Your approved rate and term will depend on factors like creditworthiness, amount financed, and the vehicle’s age, value, and condition, and are subject to change at any time.

Cars, trucks, SUVs, and vans that are new or used (5 years old or newer).

No. This offer is for loans refinanced from another lender or for new loans only.

Yes. Loans must close within 30 days of application to qualify for promotional terms.

We’ll run a hard credit inquiry during the application, which may have a small, temporary impact on your score.

Savings depend on your new rate, term, and remaining balance. Many members save by lowering their APR, shortening the term, or both. We’re happy to run the numbers for you before you commit.

Yes. You can choose a term (up to 96 months) that fits your budget and goals—either lowering your payment or paying off sooner.

A valid ID and SSN, proof of income, your current loan statement/10-day payoff, and vehicle info (VIN, mileage, year/make/model). We’ll let you know if anything else is needed.

Auto Loans

AutoPay is a convenient service that automatically withdraws your loan payment each month from your People Driven Credit Union checking or savings account. It helps you stay on track, avoid late fees, and may even qualify you for our ¹Special Loan Rate Discount.

To enroll in AutoPay, please call us at 248-263-4100 and a representative will assist you with setup.

Our ¹Special Loan Rate Discount offers a 0.25% APR reduction when you set up automatic payments (AutoPay) for your loan from a People Driven Credit Union checking or savings account. This discount is already included in the “as low as” rate advertised.

To enroll in AutoPay and receive the discount, please call us at 248-263-4100. A representative will assist you in setting up monthly automatic withdrawals from your PDCU account.

Note: The discount is available only for eligible loans with AutoPay set up from a PDCU account. Terms and conditions may apply.

Yes, enrolling in autopay may qualify you for a rate discount, reducing the overall cost of your loan. Check with our team for current promotional details.

Your credit score plays a big role in determining your loan’s interest rate and terms. Borrowers with higher credit scores typically qualify for lower interest rates, while those with lower credit scores may face higher rates.

- New auto loans apply to brand-new cars, trucks, vans, and vehicles five years old or newer. They often have lower interest rates because new cars typically have better collateral value.

- Used auto loans apply to pre-owned vehicles older than five years; interest rates may be slightly higher since used cars have less value over time.

An auto loan is a type of financing that allows you to borrow money to purchase a vehicle. The loan is secured by the vehicle itself, meaning the lender can repossess the vehicle if you fail to repay the loan.

Missing a payment can result in late fees and negatively affect your credit score. Repeated missed payments may lead to vehicle repossession. It’s important to contact People Driven Credit Union as soon as possible if you anticipate any issues making payments on your loan from PDCU.

A down payment isn’t always required, but it’s generally a smart move. Putting money down reduces the amount you’ll need to borrow, which can lower your monthly payments and reduce the total interest paid over the life of the loan. At People Driven Credit Union, we offer 100% financing for new cars (5 years old or newer). For used cars (older than 5 years), we’ll finance up to 80% of the vehicle’s value (LTV).

- Auto loans: These are for purchasing a new or used vehicle.

- Auto refinancing: You can replace your current auto loan with a new one, typically to get a lower interest rate or change the loan term.

Term lengths for auto loans from People Driven Credit Union range from 12 months (1 year) to 96 months (9 years). The longer the term, the lower your monthly payments, but you may pay more in interest over the life of the loan.

Auto Loans Exotic Cars

That part’s easy. You can apply online, give us a call, or visit a branch to connect with a loan specialist. We’ll answer your questions, review your options, and help you decide whether an Exotic Car Loan is a good fit.

In some cases, yes. If you already own an exotic car and want to explore refinancing—whether to lower your payment or adjust your term—reach out to us. We’ll review your current loan and the vehicle details to see if we can help.

Down payment requirements can depend on the vehicle, the purchase price, and your overall financial situation. A larger down payment can sometimes improve your approval chances or lower your monthly payment. We’ll look at your full picture and discuss what makes sense for your situation.

Available terms can vary based on the vehicle, loan amount, and your credit profile. Longer terms may offer a lower monthly payment, while shorter terms may help you pay less in total interest. We’ll review options with you so you can choose a term that fits your goals.

We may be able to finance exotic vehicles purchased from either reputable dealers or private sellers, depending on the situation. The documentation required can differ, so it’s best to contact us before you sign anything so we can walk you through what’s needed.

In many cases, yes. Pre-owned exotic vehicles are often eligible, but condition, mileage, age, and value all matter. We may request additional documentation, inspections, or valuation information to confirm eligibility.

Exotic cars generally include high-end, specialty, performance, or collectible vehicles that fall outside typical mass-market models. This may include supercars, rare or limited-edition sports cars, certain luxury models, and some classic or specialty vehicles. If you’re not sure whether your dream car qualifies, ask us—we’ll review it with you.

Auto Loans: Indirect

Log in to Online Banking to update AutoPay or one-time payments. For ACH from another bank, submit a new EFT authorization.

Check your Welcome Letter for your exact due date and monthly payment amount. If you need a copy, contact us.

Give your employer PDCU’s routing number #272484988 and your account number. You can find your account number in Online Banking or on your membership documents.

Quick answer: People Driven Credit Union’s routing number is 272484988.

When you need the routing number

You use your People Driven Credit Union routing number for: • Setting up direct deposit

• Making ACH transfers and linking external accounts

• Scheduling automatic payments

• Processing certain wire instructions

Common questions

Is the routing number the same for all members?

What is a bank wire transfer at People Driven Credit Union?

How do I send a wire transfer from my PDCU account?

How much does a wire transfer cost at People Driven Credit Union?

How long does a wire transfer take with PDCU?

Domestic wires are usually processed the same business day if requested before the daily cutoff. Funds are typically available to the recipient within hours.

What information do I need to receive a wire into my PDCU account?

Give the sender these exact instructions:

• Wire to: Alloya Corporate Federal Credit Union, 26555 Evergreen, Southfield, MI 48076

• ABA: 272478075

• Credit to: People Driven Credit Union, 24333 Lahser, Southfield, MI 48033

• Account: 272484988

• Final credit: Your full name + PDCU account number + account type (Checking/Savings)

Full details: Wiring Instructions

What’s the difference between Bill Pay and a wire transfer?

You use Bill Pay to pay bills to companies — it’s usually free or low-cost, and you can schedule payments anytime.

You send a wire transfer when you need the money to arrive the same day. Wires cost $30–$50 and work best for urgent or large transfers that can’t wait 1–3 days.

Are wire transfers safe at People Driven Credit Union?

Yes — wires are one of the safest payment methods. They are final and cannot be reversed, so always verify the recipient’s details and watch for wire-fraud scams.

People Driven Credit Union’s routing number is 272484988.

Boat Loans

AutoPay is a convenient service that automatically withdraws your loan payment each month from your People Driven Credit Union checking or savings account. It helps you stay on track, avoid late fees, and may even qualify you for our ¹Special Loan Rate Discount.

To enroll in AutoPay, please call us at 248-263-4100 and a representative will assist you with setup.

Our ¹Special Loan Rate Discount offers a 0.25% APR reduction when you set up automatic payments (AutoPay) for your loan from a People Driven Credit Union checking or savings account. This discount is already included in the “as low as” rate advertised.

To enroll in AutoPay and receive the discount, please call us at 248-263-4100. A representative will assist you in setting up monthly automatic withdrawals from your PDCU account.

Note: The discount is available only for eligible loans with AutoPay set up from a PDCU account. Terms and conditions may apply.

You’ll generally need proof of income, a look at your credit history, and details about the watercraft you wish to finance. Our team is here to help every step of the way. For more information or personalized assistance, please contact a People Driven Credit Union representative at 248-263-4100.

Our application process often provides pre-approval decisions quickly, and final approval typically takes just a few days once all documentation is submitted.

Yes, enrolling in autopay may qualify you for a rate discount, reducing the overall cost of your loan. Check with our team for current promotional details.

A down payment may be needed, depending on your credit profile, the value of the vehicle or watercraft, and the specific loan structure. While not always required, a down payment can lower your monthly payments and the total amount of interest paid. Our representatives will guide you through the requirements. Call 248-263-4100 to speak with a PDCU loan officer.

Loan terms are flexible and can be tailored to fit your financial situation. At People Driven Credit Union, loan terms for recreational vehicles such as ATVs, motorcycles, boats, snowmobiles, and campers generally range from 12 to 180 months. Longer terms can lower monthly payments but may result in higher total interest paid.

Yes, PDCU finances both new and pre-owned watercraft. Rates and terms may differ, so our team can help you find the best option based on your needs.

Absolutely. Our pre-approval process gives you a clear idea of your borrowing power before you start shopping, simplifying your purchasing journey.

Interest rates vary based on factors like your credit score, loan term, and the age of the vehicle or watercraft. People Driven Credit Union offers competitive rates to make financing accessible and affordable for our members. Call 248-263-4100 to speak with a PDCU loan officer about the loan rate you can expect.

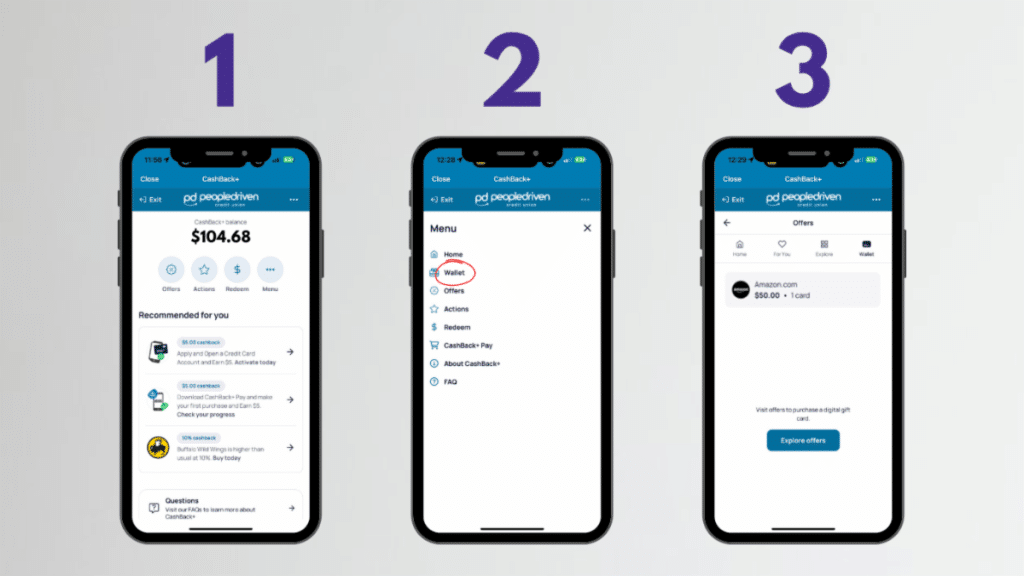

CashBack

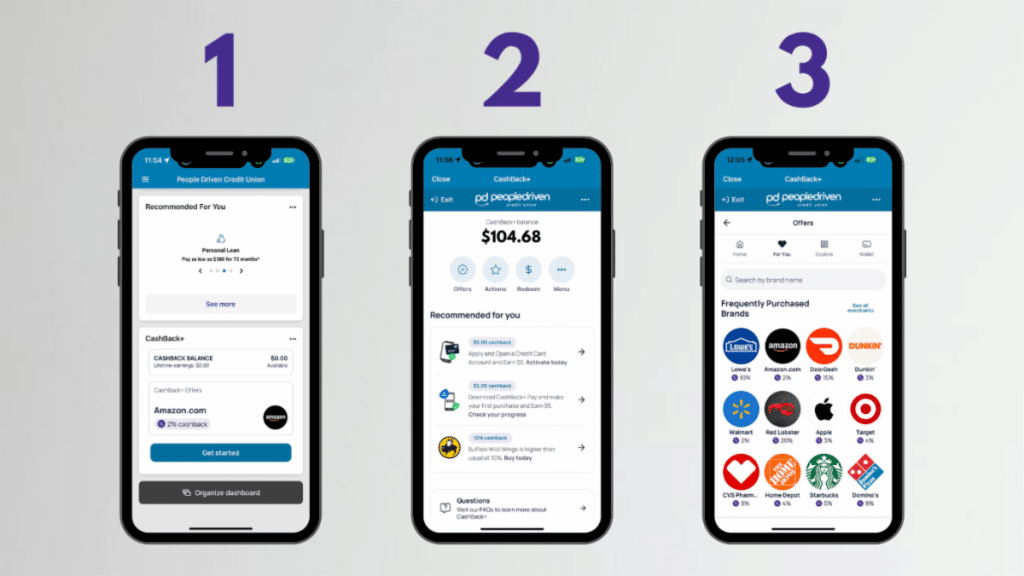

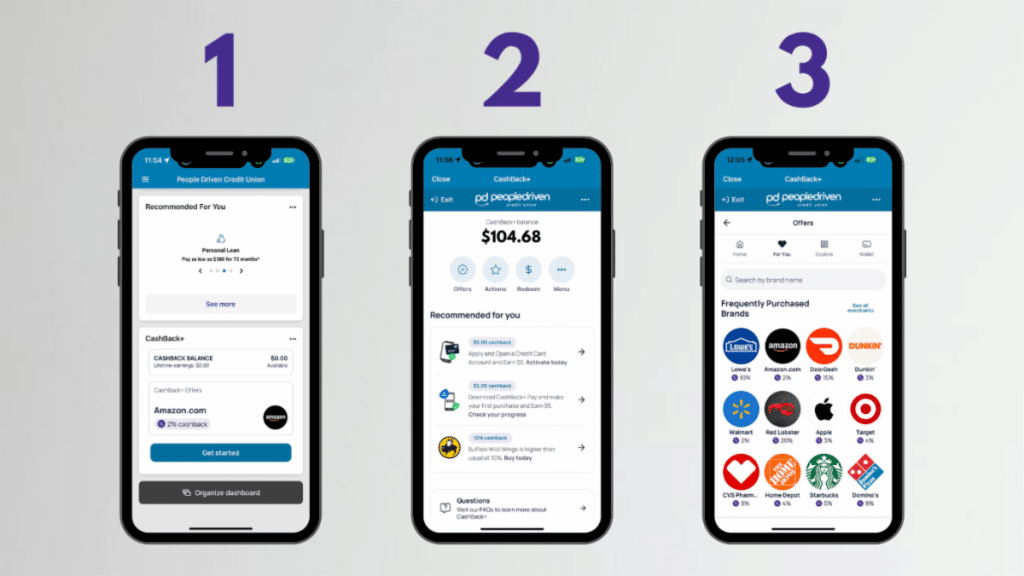

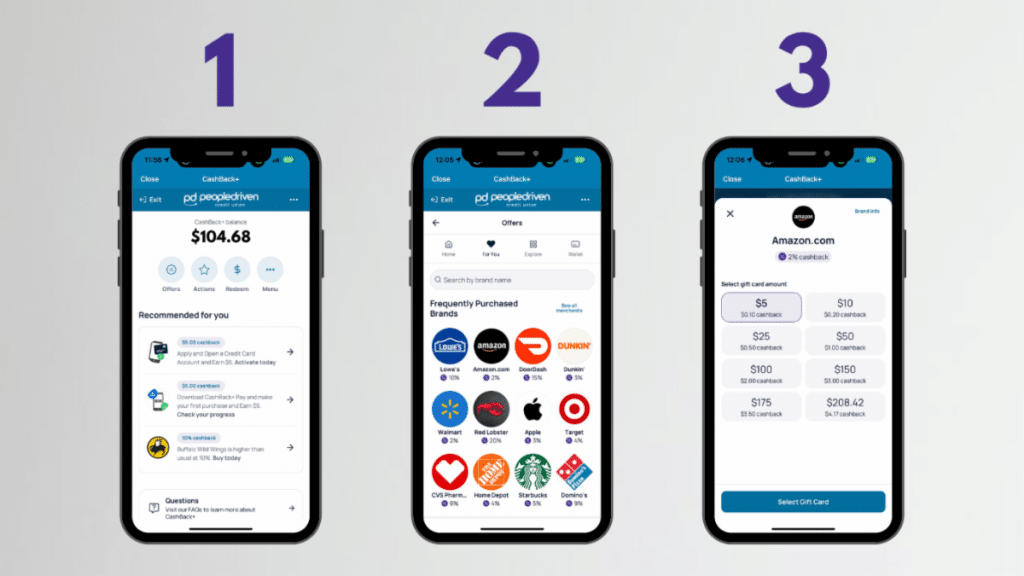

How to get started with Cashback+

- Open Your MyPDCU Mobile App

Open your MyPDCU Mile App, and locate the CashBack+ widget on your dashboard. Click Get Started. - Choose the “Offers” Button

From the four buttons below your balance, select “Offers.” - Explore the Offers!

Spend some time checking out all of the available offers for your favorite places to shop and eat!

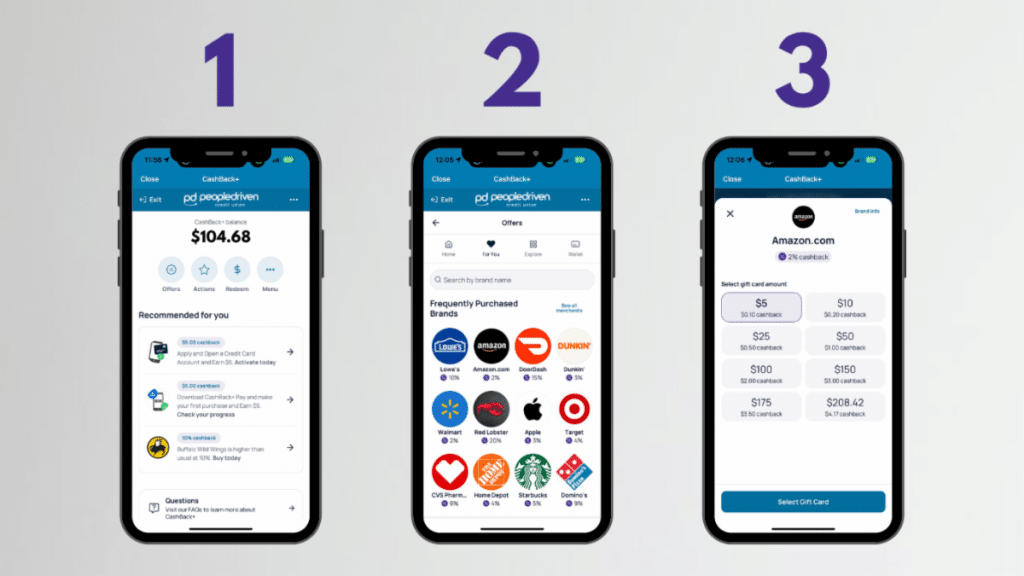

Choosing Offers

- Navigate to your CashBack+ Widget

Once inside the portal, click Offers. - Select Your Retail Brand of Choice

Scroll or search for the retail brand you want to purchase with to see what the brand’s current cash-back offer is at the time. - Purchase the Gift Card to Make a Purchase

You will purchase a gift card to cover the amount of the purchase you are attempting to make. This gift card has been purchased and stored in your CashBack+ Wallet. You can choose to use this immediately or store it in your wallet for later use.

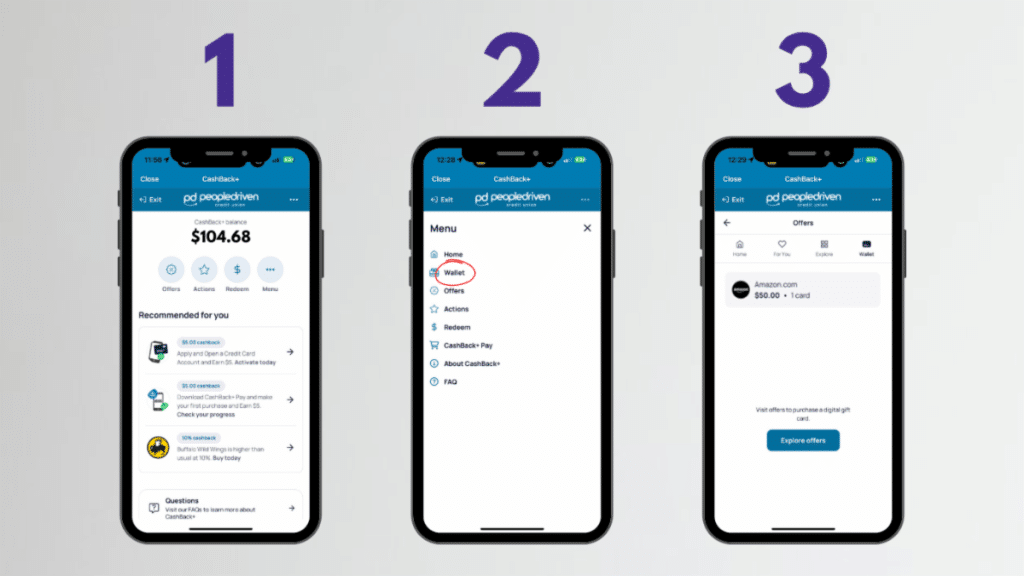

Using CashBack+ Wallet

- Navigate to your CashBack+ Widget

Once inside the portal, click More. - An Action Menu Will Appear

From the menu, select Wallet. - Select the Gift Card You Wish to Use

To use the card, click on the Gift Card you want to use from your wallet. Select Shop Now. This will direct you to the company website. Alternatively, you can use the gift card code by copying and pasting it at checkout online.

For more information about Cashback+, read our blog post, “How to Use CashBack+“.

CashBack+ is a comprehensive cashback rewards program available within your PDCU online banking. It offers personalized cashback deals, rewards for purchases, and bonus cashback for everyday banking actions.

You earn cashback by purchasing digital gift cards through Offers, using the CashBack+ Pay app at checkout, or completing certain actions such as making debit card transactions or enrolling in eStatements.

- Offers are proactive purchases of digital gift cards you plan to use later.

- Pay allows you to earn cashback on purchases you’re already making through the convenient CashBack+ Pay app.

Example: When shopping at Walmart, enter your purchase total into CashBack+ Pay, generate a barcode, scan it at checkout, and immediately earn cash back.

Digital gift cards are delivered via email and stored securely in your CashBack+ Wallet accessible within your mobile app or online banking.

Gift cards do not expire for at least five years from the purchase date.

No, there’s no limit! Earn as much cashback as you want, whenever you want.

CashBack+ is available for Android and iPhone users, as well as via the Chrome browser on desktops.

Cashback is earned instantly and visible in your CashBack+ account immediately after completing your purchase.

Yes, CashBack+ Pay is device-specific and provides enhanced security compared to traditional card transactions.

CD

You must be the child’s parent, grandparent, or legal guardian to open and manage an account. As the joint account holder, you’ll be able to set up account alerts, parental controls, online access and more.

It’s a bank account that can help your kids and teens learn to manage money. Our youth accounts come with both a checking and saving account where parents are able to set up alerts and limits. Plus, you can guide your child through real-world experiences like using an ATM. There’s a minimum of $5 for the first deposit – and no monthly service fee.

Our youth accounts are for ages 0-17.

A 16-month CD (Certificate of Deposit) is a type of savings account offered by banks and credit unions. Here are the key characteristics:

- Fixed Term: It has a maturity period of nine months, during which the deposited money is locked in.

- Interest Rate: Typically offers a fixed interest rate generally higher than regular savings accounts.

- Minimum Deposit: Often requires a minimum deposit amount to open the account.

- Early Withdrawal Penalty: If you withdraw the funds before the 16-month term ends, you usually incur a penalty, a portion of the interest earned, or a specified fee.

- FDIC Insured: In the United States, CDs from credit unions are usually insured by the National Credit Union Administration (NCUA) up to $250,000 per depositor per credit union.

A 16-month CD can be a good option if you have a specific short-term savings goal and want to earn a higher interest rate without taking on much risk.

A 16-month CD works as follows:

- Opening the CD: You deposit a lump sum of money into the CD account. The amount often needs to meet the bank or credit union’s minimum deposit requirement.

- Fixed Term: The money is committed to the CD for a fixed term of nine months. During this period, you cannot add to or withdraw from the principal amount without incurring penalties.

- Interest Rate: The bank or credit union pays you a fixed interest rate on the deposited amount for the entire term. This rate is usually higher than that of a regular savings account because the bank can use your money for a predictable period.

- Interest Accumulation: Interest is typically compounded and credited to your account at regular intervals, such as monthly or quarterly.

- Maturity: At the end of the 16-month term, the CD matures. You then have a few options:

- Withdraw the funds: You can take out your initial deposit plus the interest earned.

- Renew the CD: You can roll over the funds into a new CD, either for the same term or a different one, possibly at a new interest rate.

- Transfer the funds: You can transfer the money to another account.

- Early Withdrawal Penalty: If you need to access the money before the 16-month term ends, you will likely face an early withdrawal penalty. This penalty varies by institution but generally involves forfeiting a portion of the interest earned.

- FDIC/NCUA Insurance: If the CD is held at a bank, it is insured by the FDIC (Federal Deposit Insurance Corporation) up to $250,000 per depositor per bank. If held at a credit union, it is insured by the NCUA (National Credit Union Administration) with the same coverage limits.

A 16-month CD can be a suitable option for short-term savings goals, offering a balance between earning a higher interest rate and having your money tied up for a relatively short period.

Yes, your money is safe in a 16-month CD. At People Driven Credit Union, our CDs are insured by the NCUA (National Credit Union Administration) up to $250,000 per depositor.

Withdrawing money from a 16-month CD before the term ends typically incurs an early withdrawal penalty. At People Driven Credit Union, the Early Withdrawl Penalty is a Loss of 90 days of interest for withdrawing funds early.

APY stands for Annual Percentage Yield. It is a measure of the total amount of interest earned on an account based on the interest rate and the frequency of compounding over a year. APY is a useful metric for comparing the annual earnings on different savings products, such as savings accounts, CDs, and money market accounts, because it standardizes the effect of compounding.

Key Points About APY

- Includes Compounding: APY accounts for how often interest is compounded (e.g., daily, monthly, quarterly), which can significantly affect the total interest earned over time.

- Comparison Tool: APY provides a standard way to compare the annual interest earnings of different savings products, regardless of how frequently interest is compounded.

- Formula: The formula for calculating APY is:

APY = (1 + r/n)^n - 1

where r is the nominal interest rate (expressed as a decimal), and n is the number of compounding periods per year.

- Higher APY: A higher APY indicates that you will earn more interest on your money over a year, assuming the same principal amount.

Example

For example, if a savings account offers an interest rate of 5% compounded monthly, the APY would be higher than 5% due to the effect of monthly compounding. This makes APY a useful metric for comparing the real return on different financial products.

You will receive a notice in the mail 30 days before the maturity date of your CD.

Once the initial deposit has been made funds cannot be added to the CD until maturity. Once the CD matures you may add funds if you wish to renew the CD.

Checking

Overdraft Protection Transfer is an optional service offered by People Driven Credit Union that allows eligible members to link a savings account to a checking account. If there are insufficient funds in your checking account to cover a transaction, available funds from the linked savings account may be automatically transferred to cover the shortfall.

This service is designed to reduce the likelihood of declined transactions or returned items due to insufficient funds (NSF).

Key details:

- Transfers occur only if sufficient funds are available in the linked account.

- A per-transfer fee may apply. View our current fee schedule.

- Funds are transferred in the exact amount needed to cover the transaction, subject to available balance and transfer limits.

Overdraft Protection Transfers are subject to account eligibility, terms, and limitations. Not all accounts qualify. Transfers from savings accounts are subject to regulatory and policy limits. For full details, contact a PDCU representative or review our account disclosures.

Courtesy Pay is a discretionary overdraft service offered by People Driven Credit Union to eligible members with checking accounts in good standing. If you do not have sufficient funds available in your account to cover a transaction, we may choose to pay it on your behalf, up to a preset limit. This service is intended to help avoid declined transactions or returned items due to insufficient funds (NSF).

Courtesy Pay may apply to the following types of transactions:

- Checks

- ACH transactions (such as electronic bill payments)

- Recurring debit card payments

To extend Courtesy Pay coverage to everyday debit card transactions (such as point-of-sale or ATM transactions), you must provide affirmative consent (opt-in). Contact us to learn more or to request opt-in coverage.

Important Disclosures:

- Eligibility is based on account history and credit union discretion. Not all accounts qualify.

- A per-item overdraft fee will apply to each transaction we pay using Courtesy Pay. View our current fee schedule.

- There is no guarantee that we will authorize and pay any transaction, even if your account is eligible for Courtesy Pay.

Courtesy Pay is not a line of credit. Any negative balance must be repaid promptly. Repeated or excessive use may result in suspension of the service.

Courtesy Pay is a discretionary service provided by People Driven Credit Union. The credit union reserves the right to suspend or discontinue this service at any time. Terms, conditions, and eligibility requirements apply. For full details, contact us or review our Courtesy Pay disclosure.

Overdraft Options

Life happens, and sometimes your balance doesn’t quite cover a transaction. At People Driven Credit Union, we offer several ways to help you manage those moments:

1. Overdraft Protection Transfer

Link your Basic Checking Account to a PDCU savings account. If your balance runs low, funds will automatically transfer (if available) to cover your transaction. A small transfer fee may apply; please refer to the Fee Schedule for details.

2. Courtesy Pay

With Courtesy Pay, we may authorize and pay overdrafts on your account at our discretion, up to a preset limit, for checks, ACH payments, and recurring debit transactions. This can help avoid declined payments or returned items.

- Available to eligible accounts in good standing

- Applies to checks, ACH, and recurring payments (opt-in required for everyday debit card use)

- A per-item fee applies for each overdraft covered

Important: Courtesy Pay is a discretionary service, not guaranteed. You must bring your account to a positive balance within 30 days to remain eligible. Other restrictions may apply.

3. No Overdraft Service

You may also choose to opt out of all overdraft services. Transactions that exceed your balance will be declined, and no overdraft fee will apply.

Do you have questions about your overdraft protection options, or would you like to set your preferences? Contact our Member Services team — we’re here to help you choose the option that’s right for you.

Gone are the days when you had to visit a branch to deposit your checks. With People Driven Credit Union’s mobile check deposit service, managing your finances becomes a breeze. This technology, known as remote deposit capture, lets you deposit checks from anywhere by simply snapping a picture with your device.

How Mobile Check Deposit Works:

- Set the Stage: Place your check against a dark background to ensure all details are captured clearly due to the contrast.

- Sign and Specify: Endorse the back of the check and write “For Mobile Deposit Only to PDCU” along with your clear signature and account number to streamline processing.

- Open the MyPDCU App: Log in and select “Deposits.”

- Enter the Check Details: Enter the check amount and select the account where you want to deposit it.

- Capture the Check Images: Place the front of the check within the phone’s frame and tap the screen to capture an image. Repeat for the back of the check.

- Verify the Deposit: Check your transaction history in the app to ensure the deposit was successful.

- Secure Disposal: After confirming the deposit, cut up the check to secure your personal information. Dispose of the pieces separately.

The check will be deposited into the requested account and become available according to our standard check processing timeline. Past deposits can be viewed in the app.

For additional details, please visit our website at peopledrivencu.org/amazing or contact us if you have questions.

Embrace simplicity and security with our digital banking solutions. At People Driven Credit Union, we’re here to make your financial management effortless.

For wiring funds to a People Driven Credit Union account:

Wire to:

- Alloya Corporate Federal Credit Union

26555 Evergreen

Southfield, MI 48076

ABA number: 2724-78075

Credit:

- People Driven Credit Union

24333 Lahser

Southfield, MI 48033

Account Number: 2724-84988

Final Credit Member Name:

- Member’s PDCU Account Number

Member’s Address

Account member wants funds deposited into (for example, Savings or Checking)

Electronic Fund Transfer (EFT) Disclosure – Reg E:

You have rights under the Federal Electronic Fund Transfer Act (Reg E). For questions or to report an unauthorized EFT, call us at (248) 263‑4100 immediately.

• Report errors within 60 days of statement receipt.

• We will investigate and correct errors within 45 days.

For complete details, see our Electronic Funds Transfer Disclosures page.

PDCU’s checking accounts require no minimum balance and have no monthly maintenance fees!

Many members ask whether there is a minimum balance requirement for a checking account, as they want simple, fee-free banking.

No Monthly Maintenance Fees

PDCU checking accounts have zero monthly service charges. This keeps more money in your pocket every month.

Great Features Included

You get a free Visa Debit Card, free online banking, free mobile app, free bill pay, and free mobile check deposit — all with no minimum balance and no monthly fees.

Common Questions

Is there a minimum balance for a checking account?

PDCU’s checking accounts do not require a minimum balance and have no monthly maintenance fees!

Get Help from Our Team

Call us at 844-700-7328 during business hours if you have questions. Our team helps you open or switch to a checking account with no minimum balance. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.

5 Helpful Hints About Our Checking Account

- Open your account with any amount you want — no minimum required.

- Enjoy free mobile check deposit and online bill pay right away.

- Use the free Visa Debit Card for everyday spending.

- Set up direct deposit to make managing your money even easier.

- Contact us at 248-263-4100 to switch to a no-fee checking account today.

People Driven Credit Union keeps checking accounts simple and affordable. You never worry about minimum balance requirements or monthly fees. Many members love the freedom and low-cost banking we provide. Thank you for banking with us. .

To make a mobile deposit to your PDCU account using your smartphone, log into your MyPDCU app or the MyPDCU online banking portal and click on “Deposit.” Enter the check amount, click “Continue,” and select which of your accounts (if you have more than one) you want to make the deposit to. Sign your check, write “For Mobile Deposit Only at PDCU”, and include your PDCU account number. Follow the instructions provided in the app to capture an image of the front and back of the check.

Anything deposited over $2,500 will be reviewed by the credit union and will not show in your account right away. Check limit is $25,000. All deposits are subject to holds.

Securely store the original check for 7 business days after the deposit. Verify you check has been credited to your account. After 7 business days, destroy the original check by marking it “VOID” and shredding it.

5 Helpful Hints for Mobile Deposits

- Always write “For Mobile Deposit Only at PDCU” and your account number clearly on the back.

- Take photos in good lighting on a dark background for the clearest images.

- Deposit before 5:00 p.m. on business days for faster availability.

- Check your account balance in the app after 24–48 hours to confirm the funds posted.

- Contact us at 844-700-7328 if your deposit is over $2,500 or if you have any questions.

Making a mobile deposit at People Driven Credit Union is simple, secure, and available 24/7 through the MyPDCU app. You can deposit checks from anywhere without visiting a branch. Many members use this feature weekly and love how quickly funds become available. Always follow the 7-day storage rule and shred the original check once the deposit clears. This keeps your money protected while giving you the convenience you expect from your credit union. Thank you for banking with us. Our team is always ready to help you with mobile deposits or any other account questions.

How do I avoid overdrafts at People Driven Credit Union?

You can reduce overdraft risk by tracking balances, setting alerts, and using account tools offered by People Driven Credit Union. Many members ask how to avoid overdrafts and keep their checking accounts healthy and fee-free.

How to avoid overdrafts

- Set low-balance alerts in digital banking.

- Review pending transactions before spending.

- Keep a small buffer in your checking account.

Avoiding overdrafts at People Driven Credit Union starts with good habits. You stay in control and skip the $30 per-item fees. We give you easy tools to help every day.

Set Low-Balance Alerts

Log into online banking or open the MyPDCU app. Go to Alerts. Set a low-balance notification for $50 or $100. You get a text or email before you run low.

Review Pending Transactions

Check your account daily in the app. Look at pending purchases and ACH items. This helps you know your true available balance before you spend.

Choose Overdraft Options

We offer Overdraft Protection Transfer for $3 per transfer from linked savings. Courtesy Pay covers items for $30 each at our discretion. You can also opt out of all coverage so transactions decline with no fee.

Common Questions

Does PDCU offer overdraft options?

Available options vary by account and member eligibility. Contact PDCU to review your coverage settings.

Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team reviews your options right away. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.

5 Helpful Hints to Avoid Overdrafts

- Turn on low-balance alerts today in the MyPDCU app.

- Review pending transactions every morning.

- Keep at least $50 extra in checking as a buffer.

- Link savings for Overdraft Protection Transfer if you want automatic help.

- Contact us at 248-263-4100 to set or change your overdraft preferences.

People Driven Credit Union helps you avoid overdrafts with smart tools and flexible options. You protect your account and save on fees. Many members use alerts and buffers successfully every month. Thank you for banking with us. Our team is always ready to help you manage your checking account.

How do I order checks at People Driven Credit Union?

You can order checks through People Driven Credit Union using our approved check-ordering service. M

How to reorder checks

- Use the check reorder link provided by inside online banking.

- Confirm your account and shipping information.

- Submit your order and watch for delivery timing updates.

Ordering checks at People Driven Credit Union is fast and secure. Existing members reorder directly through online banking. You receive high-quality checks from our authorized provider delivered straight to your home.

Reorder Checks in Online Banking

Log into online banking at my.peopledrivencu.org. Click on your checking account. Scroll about halfway down the page to find the “Check Reorder” link. Click it and follow the prompts to complete your order.

Reorder Checks in the Mobile App

Open the MyPDCU app on your phone. Go to your checking account details. Look for the Check Reorder option. Confirm your details and submit the order. It is quick and easy.

Common Questions

Can I reorder checks online?

Yes. Existing members can typically reorder checks online through the authorized provider link.

Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team helps you order checks. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.

5 Helpful Hints for Ordering Checks

- Log into online banking and locate the Check Reorder link on your checking account page.

- Double-check your shipping address before you submit the order.

- Reorder when you have about 15-20 checks left to avoid running out.

- Watch for delivery timing updates after you submit your order.

- Contact us at 248-263-4100 if you need help ordering checks.

People Driven Credit Union makes it easy to order checks. You keep your checking account running smoothly with fresh supplies. Many members reorder every few months. Thank you for banking with us. Our team is always ready to help you with your checking needs.

How do I choose the right checking account at People Driven Credit Union?

People Driven Credit Union offers checking account options designed for everyday spending, digital banking convenience, and member-focused service.

Many members ask how I choose the right checking account to perfectly fit their daily needs.

Checking options at PDCU

- Every day, checking for deposits, payments, and debit card use

- Digital access through online and mobile banking

- Member support for account setup, card services, and account questions

Choosing the right checking account at People Driven Credit Union is easy because we keep it simple. Our main PDCU Checking Account has no monthly maintenance fee and no minimum balance requirement. You get a free Visa Debit Card, online bill pay, mobile check deposit, and 24/7 digital access through the MyPDCU app.

Why Members Love Our Checking Account

You enjoy free ATM access at thousands of locations nationwide. Use Round Up to Win to automatically save spare change. Overdraft options give you flexibility when needed. All this comes with friendly local support from a Michigan-based credit union.

How to Open Your Checking Account

Apply online in minutes or stop by any branch. You need your ID, Social Security number, and initial deposit. Our team walks you through setup and helps you add direct deposit or bill pay right away.

Common Questions

How do I choose the right checking account?

Compare account features, fees, and usage needs, then contact PDCU for help selecting the best fit.

Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team reviews your needs and recommends the best checking account. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.

5 Helpful Hints for Choosing Your Checking Account

- Think about how often you use debit and mobile deposit.

- Decide if you want overdraft protection or to opt out.

- Check if you qualify for direct deposit perks.

- Consider linking savings for easy transfers.

- Contact us at 248-263-4100 to compare options side by side.

People Driven Credit Union designs checking account options that makes life simpler. You get powerful tools with personal service. Many members switch and love the fee-free experience. Thank you for banking with us. Our team is always ready to help you choose the right checking account and get started today.

Construction Mortgage

Meet Our PDCU Mortgage Specialist

Michelle Dzon is authorized to act as an agent on behalf of People Driven Credit Union. Contact her for personalized assistance with your mortgage needs.

Michelle Dzon

Member First Mortgage

michelle.dzon@memberfirstmortgage.com

616-301-1714 | NMLS ID: #401292

If construction costs exceed the loan amount, you will be responsible for covering the additional expenses. It’s crucial to have a detailed budget and contingency plan to avoid running short on funds during construction.

Due to the increased risk involved, interest rates for construction loans are generally higher than for traditional mortgages. Rates can be variable or fixed and are determined based on your credit profile, loan amount, and market conditions.

Eligibility requirements can vary but typically include a good credit score, a stable income, a detailed construction plan, and a contract with a licensed builder. Some lenders may also require a down payment.

Construction loans can be used to cover the costs associated with building a new home. This includes land purchase (if not already owned), construction materials, labor, permits, and other related expenses.

A one-time close construction loan combines your construction financing and permanent mortgage into a single loan. You only have to go through the closing process once, saving you time and money on additional closing costs and paperwork.

Construction loans provide funds in stages as your home is being built. These funds are disbursed to your builder based on a pre-agreed schedule, often called “draws.” During construction, you typically make interest-only payments on the disbursed amounts. Once construction is complete, the loan transitions to a permanent mortgage, and you start making regular mortgage payments.

A construction mortgage loan is a type of loan specifically designed to finance the construction of a new home. It typically involves two phases: the construction phase, where the loan funds the building process, and the permanent mortgage phase, where the loan converts into a standard mortgage upon completion of the home.

To apply for a mortgage, you will need to provide the following documents to verify your identity, income, assets, and employment.

Required Documents & Why They are Needed

- Copy of your driver’s license or state-issued ID – Verifies your identity and legal name.

- Last 2 years of W-2 forms – Prove your employment history and income stability.

- Most recent 30 days of pay stubs – Shows your current income and allows us to calculate your debt-to-income ratio accurately.

- Last 2 years of Federal Tax Returns (including all schedules) – Confirms your reported income and helps lenders assess your overall financial picture.

- Most recent two months of bank statements (all pages) – Verifies your assets, down payment funds, and that you have enough reserves after closing.

- Contact information for your homeowner’s insurance agent – Required to set up the proper insurance coverage for the property at closing.

Why These Documents Matter

Lenders use these documents to confirm you can afford the loan and meet underwriting guidelines. Having them ready when you apply can shorten your approval time from weeks to days.

5 Helpful Hints When Preparing Mortgage Documents

- Gather everything before you apply — it can save you weeks of delays.

- Make sure all pages of the bank statements are included.

- Include all W-2s and tax returns, even if you filed jointly.

- Scan or take clear photos of your documents for easy upload.

How do I check my loan application status at People Driven Credit Union?

You can check your loan application status by contacting People Driven Credit Union or your assigned loan specialist. Many members ask how do I check my loan application status because they want fast updates on their progress.

How to check the status

- Call PDCU member or loan support at 248-263-4100.

- Have your identifying information ready for verification.

- Ask whether any additional documents are needed to proceed.

Checking your loan application status at People Driven Credit Union is simple and secure. You receive clear answers quickly. Our team keeps you informed every step of the way.

Call for Your Status Update

Pick up the phone and dial 248-263-4100 during business hours. Our loan specialists answer right away. Give them your name, application number, or Social Security number. They pull up your file instantly.

Prepare for the Call

Have your driver’s license or member number ready. Note any recent emails or letters from us. This speeds up the process so you get answers faster.

Common Questions

How long does a review usually take?

Timing varies by loan type and application volume, so contact PDCU for your current status timeline.

Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team checks your status right away. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.

5 Helpful Hints for Checking Your Loan Application Status

- Call early in the day for shorter wait times.

- Write down your application number before you call.

- Ask for an email summary of your current status.

- Check your spam folder for any updates from PDCU.

- Contact us at 248-263-4100 if you need to submit more documents.

People Driven Credit Union keeps you informed about your loan application status. You feel confident knowing exactly where things stand. Our team works hard to move your application forward quickly. Many members receive approval updates within days. Thank you for trusting us with your loan needs. Our team is always ready to help you reach your financial goals.

Debit/ATM card

Overdraft Protection Transfer is an optional service offered by People Driven Credit Union that allows eligible members to link a savings account to a checking account. If there are insufficient funds in your checking account to cover a transaction, available funds from the linked savings account may be automatically transferred to cover the shortfall.

This service is designed to reduce the likelihood of declined transactions or returned items due to insufficient funds (NSF).

Key details:

- Transfers occur only if sufficient funds are available in the linked account.

- A per-transfer fee may apply. View our current fee schedule.

- Funds are transferred in the exact amount needed to cover the transaction, subject to available balance and transfer limits.

Overdraft Protection Transfers are subject to account eligibility, terms, and limitations. Not all accounts qualify. Transfers from savings accounts are subject to regulatory and policy limits. For full details, contact a PDCU representative or review our account disclosures.

Contactless cards offer several benefits over traditional cards that require a physical swipe or insertion into a card reader. Some of these benefits include: