Building wealth isn’t just about earning more; it’s about building something that still stands a decade from now, and ideally, helps the next generation start stronger than you did.

Financial Lessons from Black Leaders: Building Wealth That Lasts

Many Black leaders and modern financial educators emphasize a set of principles that are simple, practical, and powerful: own assets, create opportunities, invest consistently, understand your money, and reinvest in your community. Here are a few lessons worth borrowing, no matter where you’re starting from.

1) Own Assets, Not Just Income

Working hard can earn a paycheck. But asset ownership is what builds long-term wealth. Assets are things that can grow in value, generate income, or create future opportunities, such as businesses, real estate, investments, and intellectual property.

People Driven takeaway: Think beyond “Can I afford this payment?” and ask, “Will this help me build something over time?”

- Build emergency savings so you can handle surprises without high-cost debt.

- Reduce high-interest balances so more of your money stays in your household.

- Invest when you can (even small amounts) so time can do some of the heavy lifting.

2) Create Your Own Opportunities (Entrepreneurship + Initiative)

One consistent theme from Black business leaders, echoing the spirit of pioneers like Madam C.J. Walker, is this: don’t wait for a door to open if you can build one.

That doesn’t always mean launching a full-time business tomorrow. Sometimes it’s a side hustle, freelancing, or turning a skill into a service. The real point is initiative: creating options when options are limited.

Try this: Start small and structured.

- Separate side income into its own account.

- Track what’s coming in and going out (profit matters more than “busy”).

- Reinvest a set percentage into tools, training, or marketing.

3) Invest Early and Often (Consistency Beats Perfection)

Modern financial educators like Bola Sokunbi consistently emphasize that investing is a key wealth-building lever. The big idea: investing isn’t about timing the market, it’s about time in the market and steady contributions.

People Driven takeaway: Don’t wait until you feel “ready.” Start with what you can sustain.

- Automate a small recurring amount.

- Increase it gradually when your income grows or debts shrink.

- Keep your focus on long-term goals, not short-term noise.

Note: Investing involves risk, including possible loss of principal. Consider your goals and time horizon, and talk to a qualified financial professional if needed.

4) Understand Your Money (Clarity = Confidence)

Educators like Jamila White often stress a foundational truth: financial freedom requires knowing exactly what you have—and managing it intentionally. You don’t have to obsess over every penny, but you do need a clear picture.

Start with a simple “money snapshot”:

- Monthly take-home income

- Fixed bills (housing, car, insurance, utilities)

- Minimum debt payments

- Average spending (food, gas, subscriptions, “life happens”)

- Current savings

Once you can see it, you can improve it. Before that, it’s just vibes and wishful thinking.

5) Pivot and Adapt (Because Life Doesn’t Follow a Spreadsheet)

Successful entrepreneurs adapt. Markets change. Family needs change. Income changes. The people who build wealth over time aren’t the ones who never hit obstacles—they’re the ones who adjust quickly without abandoning the plan.

People Driven takeaway: Build flexibility into your finances.

- Keep a starter emergency fund (even $500–$1,000 makes a difference).

- Avoid stacking new payments until your budget has breathing room.

- If you need to borrow, borrow with a plan—and a clear payoff strategy.

6) Leverage Financial Literacy (And Don’t Be Afraid to Get Help)

Educators like Tiffany Aliche (“The Budgetista”) remind people that budgeting, saving, and managing debt are learnable skills, and it’s smart to ask for support. Nobody’s born knowing APR, credit utilization, or why your “free trial” subscription keeps coming back like a boomerang.

Try this: Pick one skill to strengthen this month:

- Build a simple budget you’ll actually use

- Pay down one high-interest balance faster

- Improve your credit with a consistent payment plan

- Set up automatic savings

7) Economic Empowerment Through Community Reinvestment

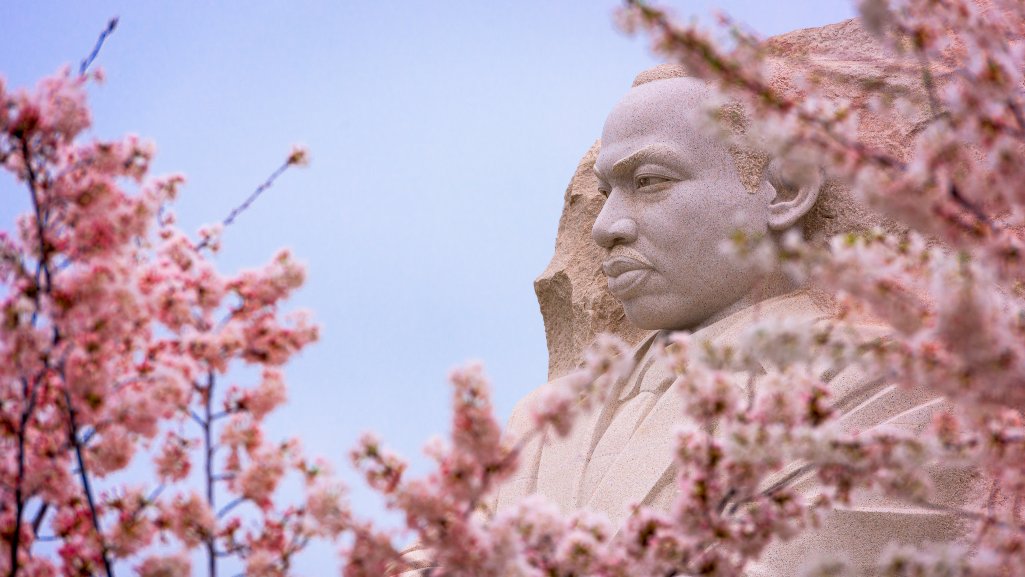

Dr. Martin Luther King Jr. emphasized economic justice as a core part of progress. Today, many leaders carry that forward by encouraging community reinvestment—supporting local businesses, building networks, and keeping dollars circulating in the community.

What this can look like in everyday life:

- Supporting Black-owned and locally owned businesses when you can

- Sharing opportunities, resources, and referrals

- Teaching money basics at home so the next generation starts with a head start

Actionable Takeaways You Can Start This Week

Diversify income: Explore a side skill, freelance work, overtime opportunities, or a small service-based hustle that fits your life.

Build a legacy: Make decisions that help future-you and future-them, like saving consistently, improving credit, and reducing high-cost debt.

Persistence: Progress isn’t one big moment. It’s steady effort over time, especially when the goal is lasting equity and stability.

A Simple “Next 30 Days” Plan

- Set up an automatic transfer to savings each payday (even $10–$25)

- Choose one debt to attack with a little extra

- Cancel or renegotiate one recurring expense

- Make a “money snapshot” and review it weekly for a month

Small moves, repeated, become big results. That’s how wealth gets built—quietly, consistently, and with purpose.

Budgeting Help + Savings Options + Smart Borrowing

Want a simple plan you can stick to? People Driven Credit Union has tools to help you budget with clarity, grow your savings, and borrow wisely when it supports your goals.

Budgeting help:

- Explore financial education resources

- Use the MyPDCU app & online banking to track spending and stay organized

Savings options:

Smart borrowing options:

This article is for educational purposes and is not financial, investment, or legal advice. Membership and eligibility requirements apply. All loans subject to credit approval.