A Back-to-School Cash Loan for Educational Expenses

Preparing for the academic year can strain your budget due to expenses like school supplies, clothing, and tuition. Other educational costs can also add to the burden. People Driven Credit Union (PDCU) is here to help. Our Back-to-School Cash loan is designed to ease your financial burden and help you manage these costs effectively.

Flexible Loan Amounts:

$1,501 to $2,000:

For members in good standing, if they’ve had at least $1,000 in monthly direct deposits for the past six months.

Terms:

For a Back-to-School Cash loan of $2,000 paid off over 18 months:

| Amount Financed: | $2,000.00 |

| Origination Fee: | $35.00 |

| Loan Insurance: | Free |

| Interest Rate: | 9.99% |

| APR*: | 12.310% |

| Payment Every Month: | $120.10 |

| Total # of Payments: | 18 |

| Total Interest: | $161.89 |

| Total of Payments: | $2,161.89 |

$1,001 to $1,500:

For members in good standing, if they’ve had at least $1,000 in monthly direct deposits for the past six months.

Terms:

For a Back-to-School Cash loan of $1,001 paid off over 12 months:

| Amount Financed: | $1,001.00 |

| Origination Fee: | $35.00 |

| Loan Insurance: | Free |

| Interest Rate: | 9.99% |

| APR*: | 16.778% |

| Payment Every Month: | $88.00 |

| Total # of Payments: | 12 |

| Total Interest: | $54.99 |

| Total of Payments: | $1,055.99 |

$500 to $1,000:

For members in good standing, if they’ve had at least $1,000 in monthly direct deposits for the past six months.

Terms:

For a Back-to-School Cash loan of $500 paid off over 9 months:

| Amount Financed: | $500.00 |

| Origination Fee: | $35.00 |

| Loan Insurance: | Free |

| Interest Rate: | 9.99% |

| APR*: | 28.018% |

| Payment Every Month: | $57.89 |

| Total # of Payments: | 9 |

| Total Interest: | $21.04 |

| Total of Payments: | $521.04 |

Key Features:

- No Payments for 30 Days: Start your school year worry-free with no initial payments.

- No Credit Check: Apply without the worry of credit checks.

- Maximum Annual Percentage Rate (APR) of 28.018%

- 9, 12, & 18-Month Terms: Manageable repayment periods to suit your financial planning.

- Origination Fee: $35

A Back-to-School Cash Loan can be used for:

- Uniforms

- Computers

- Supplies

- Sports equipment

- Clothing

- Musical instruments

Everything and anything you need to help your family succeed in school this year.

Eligibility:

Members in good standing may qualify for a loan if they’ve had at least $1,000 in monthly direct deposits for the past three months. The amount available is then determined automatically based on a percentage of those deposits, up to $2,000 (minimum $500).

- To borrow up to $2,000, you’ll need to have at least $2,000 in direct deposits each month for the last three consecutive months.

- The minimum loan amount available is $500.

- PD Quick Cash and PD Seasonal Loan Special Participants: Members who previously received our PD Quick Cash loan specials are also eligible for this Back-to-School loan promotion, provided they are in good standing at the time of application.

How to Apply:

- Check Your Eligibility: Members in good standing may qualify for a loan if they’ve had at least $1,000 in monthly direct deposits for the past six months.

- Apply Online or on the MyPDCU app: You can apply for the Back-to-School loan online.

- Get Approved Quickly: Our streamlined approval process ensures you receive the funds you need promptly.

TruStage™ Payment Guard Insurance

With a PD Quick Cash Back-to-School Loan from People Driven Credit Union, you don’t just get fast access to funds—you also get free loan insurance! Our PD Quick Cash Back-to-School Loans now come with TruStage™ Payment Guard Loan Insurance, automatically included at no additional cost to you.

In the event of a covered job loss, TruStage™ Payment Guard Insurance provides a lump sum payment of $500 toward your loan balance, helping to ease your financial burden during challenging times. Stay protected and secure your financial future with a PD Quick Cash Back-to-School Loan and TruStage™ Payment Guard Insurance. Learn more about Payment Guard Insurance.

Frequently Asked Questions

Follow these steps to enable email notifications:

- Open the Mail app on your iPhone.

- To receive notifications about replies to emails or threads:

- When reading an email: Tap the left arrow and tap Notify Me.

- When writing an email: Tap the Subject field, tap the blue bell in the subject field, and then tap Notify Me.

- To adjust how notifications appear:

- Go to Settings > Apps > Mail > Notifications, then turn on Allow Notifications.

- To customize notification settings for your email account:

- Go to Settings > Apps > Mail.

- Tap Notifications and ensure Allow Notifications is turned on.

- Tap Customize Notifications and choose the settings you want for your email account (e.g., Alerts or Badges).

- You can also adjust alert tones or ringtones if you turn on Alerts.

Some members using Apple devices have reported being kicked out of the app when retrieving the security code sent to their email during the PD Quick Cash Loan application process. This happens when members leave the app to check their email for the code, which causes the app to restart. This issue doesn’t seem to affect Android devices.

To avoid being kicked out of the application process, read How can I avoid being kicked out of the app when I receive the security code?

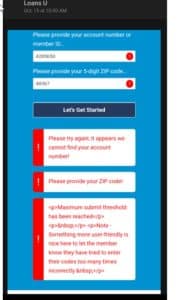

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.The origination fee for a PD Quick Cash loan is a one-time cost for convenience and speed. It allows you to secure funds instantly without a traditional credit check. This is particularly beneficial when you need urgent access to funds without the usual wait times or paperwork involved in standard loan processing. It's designed to be a fast, straightforward solution for immediate financial needs.

A one-time $35 processing fee applies, regardless of loan amount.

Disclosures:

*APR = Annual Percentage Rate.

By applying for this loan, you authorize People Driven Credit Union to access reports from third parties, including credit reporting agencies. This process could impact your credit score. Up to $2,000 loan amount, 12.310% – 28.018% estimated APR* range based on loan amount, 18-month, 12-month and 9-month terms available, $35 Origination Fee. $120.10 monthly payment on $2,000 loan amount. $57.89 monthly payment on $500 loan amount. Closing your loan is contingent upon the members’ agreement to all the required agreements and disclosures on the www.PeopleDrivenCU.org website. Enjoy the added convenience of making payments with direct deposit.

People Driven Credit Union (PDCU) will not accept requests to change the payment transfer method or due date for funded PD Quick Cash loans. By applying for and financing a PD Quick Cash loan, members agree to an automatic loan transfer scheduled 30 days from the loan date.

Loans of $500 to $2,000. 9.99% Interest Rate. Actual APR* may vary (12.310% – 28.018% estimated range based on loan amount).

- Loan Amount $500: Origination Fee $35

- Loan Amount $2,000: Origination Fee $35

PDCU Member Back-to-School Loan Qualifications

The Back-to-School Cash Loan runs from August 18, 2025, to September 30, 2025, with an Annual Percentage Rate (APR*) as low as 12.310%. $35 processing fee applies.

The Back-to-School Cash Loan is available only to members in good standing with a qualifying direct deposit of at least $1,000/month for the last six consecutive months. No credit check is performed for this loan option.

Back-to-School Loans are only available for Members of People Driven Credit Union. Members are permitted to have up to two Back-to-School Loans simultaneously; however, a 30-day waiting period is required between loan applications. People Driven Credit Union members in good standing, with a direct deposit of $1,000 or more set up for the last six months, are invited to apply online for the Back-to-School Loan. Online applications will receive an approval or denial decision within minutes. If approved, funds will be deposited directly into the member’s account within 60 seconds. Credit reports will not be checked for Back-to-School Loan applicants.

There is no prepayment penalty for this loan. To qualify, borrowers must be the primary account holder, in good standing with PDCU, have a valid email and physical address, and be current on all PDCU accounts for the last 90 days. Applicants must be at least 18 years old, and joint, business, trustee, conservatorship, and minor accounts are not eligible for this loan.

4Important Information About PD Quick Cash

“Same-day approval,” “under 60 seconds,” and “funds promptly” refer to the average time it takes to process applications for eligible members during regular business hours. Actual approval and funding times may vary based on application volume, account verification, and other eligibility requirements.

Approval is not guaranteed and is subject to credit union membership, account history, and other underwriting criteria. Applicants must be a member in good standing for a minimum of 180 days and meet eligibility criteria, which may include regular direct deposit and no recent loan delinquencies.

Members are permitted to have up to two PD Quick Cash Loans simultaneously; however, a 30-day waiting period is required between loan applications. Members are only allowed three PD Quick Cash Loan products (open or closed) in a rolling six months. Maximum of two loans at a time.

All loans are subject to credit union approval and other terms and conditions. People Driven Credit Union reserves the right to modify or discontinue this product at any time without notice.