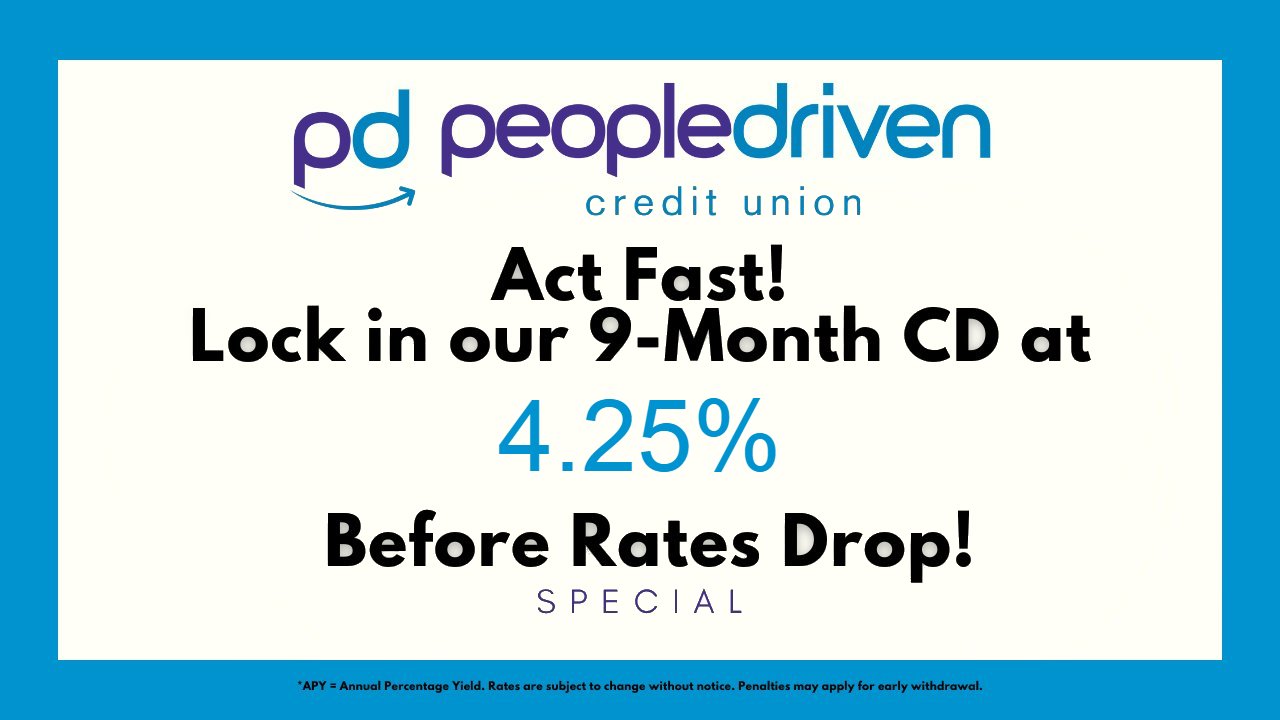

With the recent news that the Federal Reserve has lowered interest rates by 0.5%, there’s no better time to secure your savings with a high-yield investment! People Driven Credit Union is offering an incredible 4.25% APY* on our 9-month Certificate of Deposit (CD), but with rates expected to adjust soon, this opportunity won’t last long.

Why Choose a 9-Month CD?

- Guaranteed Return: Lock in this competitive rate now, and you’ll enjoy a solid return on your savings for the next 9 months, regardless of future rate changes.

- Short-Term Commitment: With a 9-month term, you’ll see the benefits of your investment sooner, giving you flexibility to reinvest or use your funds as needed.

- Secure Your Rate Today: CD rates can fluctuate based on market conditions. By opening your account now, you’re protecting your savings from any upcoming rate decreases.

How to Get Started

It’s simple to take advantage of this limited-time offer. Visit any of our branches, call us at 248-263-4100, or open your CD online to lock in your rate today. Don’t wait—when this special rate is gone, it’s gone for good!

Act fast to secure this fantastic 4.25% APY* before the Fed’s recent rate cut starts to affect savings products. Your future self will thank you!

*APY = Annual Percentage Yield. Rates are subject to change without notice. Penalties may apply for early withdrawal.