Category: Other

AI Scams 101: Same Red Flags, New Packaging

AI is doing some amazing things, like letting computers respond to questions in a human-like way (that’s the “Large Language Model” part), generate images, create videos, and even mimic real voices. And because scammers are basically raccoons...

Continue Reading

Credit Union vs. Bank: What’s Actually Different?

If you’ve ever wondered about the differences between a credit union vs. a bank, or why a credit union feels different than a bank, then you’re not imagining things. The “credit union difference” isn’t just marketing. It’s built into our...

Continue Reading

Celebrating Presidents Day

As we approach Presidents Day, February 16, 2026, a national holiday that honors the leaders who have shaped the history of the United States, People Driven Credit Union takes a moment to reflect on the significance of this day and how it impacts our...

Continue Reading

Financial Lessons from Black Leaders

Building wealth isn’t just about earning more; it’s about building something that still stands a decade from now, and ideally, helps the next generation start stronger than you did. Financial Lessons from Black Leaders: Building Wealth That...

Continue Reading

5 Ways to Save Money Every Month

Saving money every month doesn’t require a spreadsheet obsession or a “no fun allowed” lifestyle. It’s usually a handful of small, repeatable habits that keep more cash in your account—month after month. 5 Ways to Save Money Every...

Continue Reading

Account Takeover Scams Are Surging in 2026

If someone calls, texts, or emails claiming to be “your bank” and urgently needs a code from you, you’re not talking to a helper; you’re talking to a thief with a script. Scammers are impersonating financial institutions to steal logins,...

Continue Reading

Super Bowl Savings: How to Enjoy the Big Game Without Breaking the Bank

Super Bowl Sunday is basically a national holiday… with snacks. And like most holidays, it can get expensive fast. For Super Bowl LX (Sunday, February 8, 2026), kickoff is set for 6:30 p.m. ET. And according to the 2026 Super Bowl Spending Survey...

Continue Reading

How to Build an Emergency Fund (and Why It’s Important)

An emergency fund is the financial equivalent of keeping a spare tire in the trunk. You don’t plan to use it… but when you need it, you really need it. Whether it’s a car repair, an unexpected medical bill, a home maintenance surprise, or a...

Continue Reading

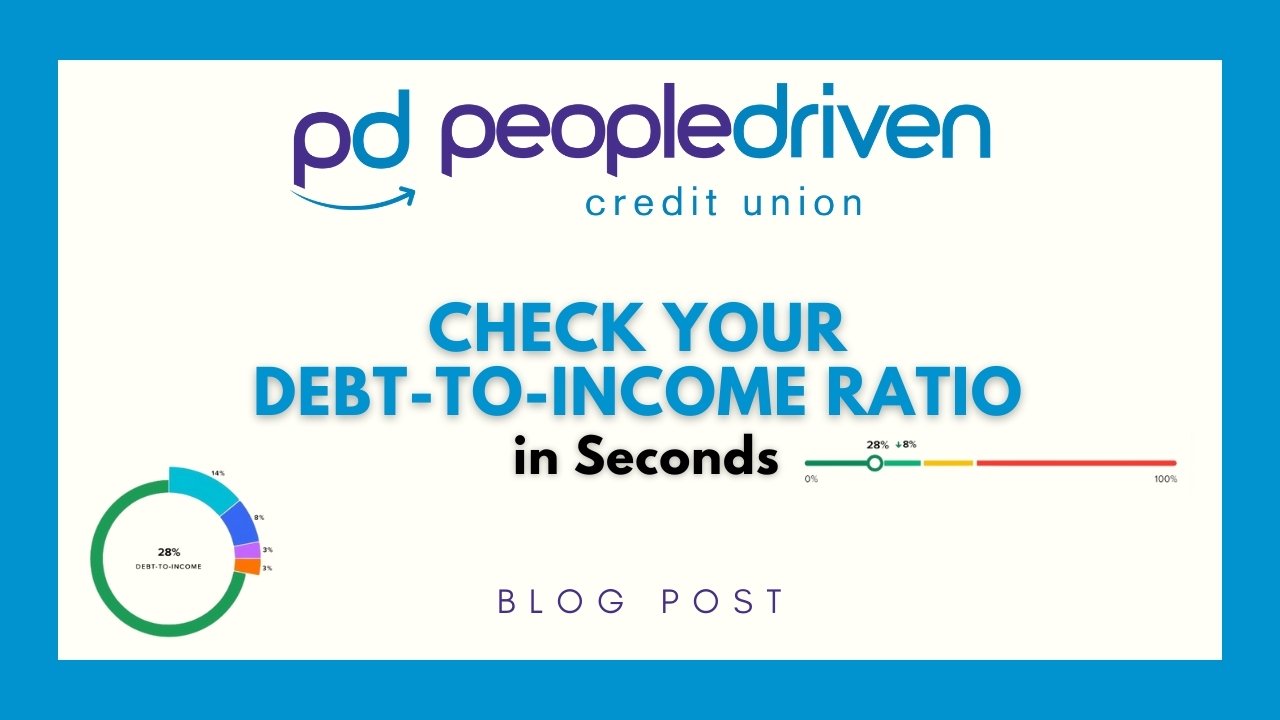

Check Your Debt-to-Income Ratio in Seconds

If you’ve ever wondered, “Am I carrying too much monthly debt?” you’re not alone—and now you’ll have a quick way to see it. Starting January 13, 2026, a new Debt-to-Income (DTI) module will be available inside the Credit Score experience in...

Continue Reading

What to Do If You Think You’re Being Scammed (or Have Been Scammed)

Scammers win by creating panic and urgency. Your job is to do the opposite: slow the situation down, verify independently, and take fast action where it matters. If you’re in the middle of a suspicious call/text right now: Hang up. Don’t reply....

Continue Reading