Everything Loans, where your financial dreams and aspirations find a flexible and tailored solution. Our Everything Loans are designed to empower you to pursue your passions, tackle life’s challenges, and seize opportunities, no matter what they may be. With a variety of personal loan options available, including our Vacation Loan, Pet Loan, Life Situational Loan, Wellness Loan, Relocation Loan, and Self-Improvement Loan, we provide the funding you need to make your dreams a reality. Whether planning your next adventure, caring for a beloved pet, navigating life’s transitions, or investing in your well-being and personal growth, our Everything Loans offer competitive rates, flexible terms, and convenient features to suit your needs. Explore our range of personal loans today and take the first step towards achieving your goals with People Driven Credit Union.

We have a loan for that!

-

Vacation Loan

o Honeymoon Loans

o Loans up to $10k

o Terms up to 60 months

-

Pet Loan

o Purchase

o Medication & Veterinary Costs

o Loans up to $5k

o Terms up to 36 months

-

Life Situational Loan

o Wedding Expenses

o Funeral Expenses

o Loans up to $15k

o Terms up to 72 months

-

Wellness Loan

o Medical expenses

o Surgery

o Rehab

o Dental

o Prescriptions

o Loans up to $25k

o Terms up to 84 months

-

Relocation Loan

o Moving Expenses

o Loans up to $8k

o Terms up to 36 months

-

Self-Improvement Loan

o Plastic surgery

o Facelifts

o Tummy tucks

o Botox

o Loans up to $20k

o Terms up to 84 months

The best things in life are free; we’re here for the other stuff.

People need money for home repairs, honeymoons, holiday gifts, travel, tuition, furnaces and furniture, doctor bills, or debt consolidation. Whatever the financial needs of your Michigan family, People Driven Credit Union has a low-cost personal loan that can make your life easy. Apply for your Everything Loan.

Frequently Asked Questions

Contact a Representative

-

How long can I take to repay a Life Situational Loan? Terms are available up to 72 months, depending on the amount financed and approval.

-

What can I use a Life Situational Loan for? These loans may be used for eligible expenses tied to major life events, including wedding-related costs and funeral or memorial expenses.

-

Can I get a Life Situational Loan with bad credit? Yes. People Driven Credit Union considers more than just your credit score, including your income and credit history. If approved, funds are deposited into your checking or savings account. Interest rates are based on your credit rating.

-

What is AutoPay? AutoPay automatically withdraws your loan payment each month from your People Driven checking or savings account. It helps you stay on track and may qualify you for the special loan rate discount. Enrollment is handled by phone at 248-263-4100.

-

What is the Special Loan Rate Discount? The special loan rate discount is a 0.25% APR reduction when you set up AutoPay from your People Driven checking or savings account. The discount is already included in the advertised “as low as” rate. Enrollment is handled by phone at 248-263-4100.

Terms are available up to 72 months, depending on the amount financed and approval.

These loans may be used for eligible expenses tied to major life events, including wedding-related costs and funeral or memorial expenses.

You can quickly check your balance in the MyPDCU Mobile App. Just log in, select your Visa® Credit Card account, and you’ll see your current balance along with any past-due amount. Together, this shows your total amount owed.

When you open a Share Secured Credit Card, you agree to place a certain amount of money in a PDCU savings account as collateral. This deposit is held while the account is open and in good standing. If the account is closed and all balances are paid, the deposit is released back to you.

Yes. Your payment history is reported to major credit bureaus. Making on-time payments and keeping your balance low compared to your limit can help improve your credit profile over time.

Responsible use of a Share Secured Credit Card—such as making on-time payments and maintaining a low balance—may help you qualify for other PDCU credit card options. Approval is not guaranteed and is subject to credit review.

Yes. Your Share Secured Credit Card can be used anywhere Visa is accepted, including online and in person, subject to your available credit limit.

Interest and fees may apply. Please review our Credit Card Disclosures for complete details.

Contactless cards offer several benefits over traditional cards that require a physical swipe or insertion into a card reader. Some of these benefits include:

- Speed: Contactless cards can be scanned quickly and easily, resulting in faster and more efficient transactions. This can be especially useful in high-traffic retail environments where lines are lengthy.

- Convenience: Contactless cards eliminate the need for physical swiping or insertion, making them particularly useful for people on the go, such as commuters or those running errands.

- Increased security: Contactless cards reduce the risk of fraud by utilizing near-field communication (NFC) technology, which establishes a secure connection between the card and the card reader. Additionally, the risk of card skimming is reduced because a contactless card remains in the cardholder's possession.

- Reduced contact: Because contactless cards can be scanned without physical contact, they can help reduce the spread of germs and bacteria, which is especially important during a pandemic.

- Adoption: Contactless payments are becoming increasingly widespread; it may be more convenient for cardholders to have contactless cards, as many merchants are now accepting them.

Contactless card transactions are generally faster and more convenient than traditional card transactions.

- The 2025 Summertime PD Quick Cash Loan application is now closed.

- For the Summertime Cash Loan, visit Personal Loan Options You can also call us at (248) 263-4100 for assistance.

- Quick Cash Loan: No credit check is required.

- Summertime Cash Loan: Yes, standard credit review applies and may affect your interest rate and approval amount.

- Quick Cash Loan: Funds may be deposited into your account within minutes after approval.

- Summertime Cash Loan: Typically funded within 5 business days upon final approval and document signing.

- PD Quick Cash Summertime Loan: Up to $2,000, 9.99% interest rate, no credit check, $35 fee, available only to current members with qualifying direct deposit.

- PDCU Summertime Cash Loan: Up to $30,000, available to both members and non-members, with credit and membership approval.

Follow these steps to enable email notifications:

- Open the Mail app on your iPhone.

- To receive notifications about replies to emails or threads:

- When reading an email: Tap the left arrow and tap Notify Me.

- When writing an email: Tap the Subject field, tap the blue bell in the subject field, and then tap Notify Me.

- To adjust how notifications appear:

- Go to Settings > Apps > Mail > Notifications, then turn on Allow Notifications.

- To customize notification settings for your email account:

- Go to Settings > Apps > Mail.

- Tap Notifications and ensure Allow Notifications is turned on.

- Tap Customize Notifications and choose the settings you want for your email account (e.g., Alerts or Badges).

- You can also adjust alert tones or ringtones if you turn on Alerts.

Some members using Apple devices have reported being kicked out of the app when retrieving the security code sent to their email during the PD Quick Cash Loan application process. This happens when members leave the app to check their email for the code, which causes the app to restart. This issue doesn’t seem to affect Android devices.

To avoid being kicked out of the application process, read How can I avoid being kicked out of the app when I receive the security code?

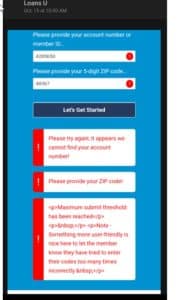

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.

If you're applying for a PD Quick Cash Loan directly from the website, the system requires your account number and zip code to verify your identity. If this information is entered incorrectly five times, you will be locked out for 24 hours.You can use a Home Improvement Loan for a wide range of projects, such as:

- Renovating a kitchen or bathroom

- Installing new windows or doors

- Adding a new room or extension

- Upgrading heating, ventilation, or air conditioning systems

- Repairing roofs or plumbing

- Improving energy efficiency with solar panels or insulation

To qualify, People Driven Credit Union will typically evaluate factors such as:

- Your credit score and credit history.

- Your income and employment status.

- Your debt-to-income ratio: Good credit and stable income improve your chances of approval and provide better loan terms.

Home Equity Loans for Borrowers With Bad Credit

A secured loan is a type of loan that requires collateral—such as a home, savings account, vehicle, or other valuable asset—to back the loan. For individuals with bad credit, secured loans, such as a home equity loan or home equity line of credit, can be a helpful option because the collateral reduces the lender’s risk, making approval more likely. By offering security, you may also qualify for better interest rates compared to unsecured loans. Plus, making timely payments on a secured loan can help improve your credit score over time. Keep in mind that if the loan isn’t repaid, the lender can claim the collateral to recover the balance. Talk to a PDCU lender to learn about your options.Improve Your Credit Score to Qualify for a Home Improvement Loan With Bad Credit

Improving your credit score before applying for a home loan can help you qualify for better rates and terms. Start by reviewing your credit report for errors and disputing any inaccuracies. Pay down existing debts, especially high-interest credit cards, and make all payments on time, as payment history is a key factor in your score. Avoid opening new credit accounts before applying for a mortgage, as this can lower your score temporarily. Taking these steps can strengthen your financial profile and increase your chances of securing a favorable home loan.- Home Improvement Loan: Typically, an unsecured personal loan, where you borrow a set amount to fund a home project, with fixed monthly payments and no collateral required.

- Home Equity Loan: A secured loan that uses the equity in your home as collateral, often offering larger loan amounts and lower interest rates than an unsecured loan.

- Lower Interest Rates: Because the loan is secured by your CD, the interest rates are typically lower than those of unsecured loans.

- Credit Building: A CD Secured Loan can help you build or improve your credit score through consistent, on-time payments.

- Preservation of Savings: You can access loan funds without breaking your CD and continue to earn interest on it.

- Credit card balances

- Personal loans

- Medical bills

- Debt Consolidation: This involves taking out a loan to pay off your existing debts, leaving you with one manageable payment. You are responsible for repaying the full amount of the loan.

- Debt Settlement: Involves negotiating with creditors to reduce the amount of debt you owe, often resulting in a negative impact on your credit score. Debt consolidation, on the other hand, typically helps preserve or improve your credit score.

A personal loan can impact your credit score in several ways:

- Positive Impact: Making on-time payments can improve your credit score.

- Negative Impact: Missing payments or defaulting on the loan can harm your credit score. Additionally, applying for a loan results in a hard inquiry, which may temporarily lower your score.

Personal loans can be used for a variety of purposes, including:

- Debt consolidation

- Home improvements

- Medical expenses

- Major purchases (e.g., appliances, electronics)

- Special events (e.g., weddings, vacations)

- Emergency expenses

- Secured Personal Loan: Requires collateral (e.g., a car or savings account). Offers lower interest rates due to reduced risk for the lender.

- Unsecured Personal Loan: Does not require collateral. The interest rate is based on your creditworthiness and may be higher than secured loans.

The origination fee for a PD Quick Cash loan is a one-time cost for convenience and speed. It allows you to secure funds instantly without a traditional credit check. This is particularly beneficial when you need urgent access to funds without the usual wait times or paperwork involved in standard loan processing. It's designed to be a fast, straightforward solution for immediate financial needs.

A one-time $35 processing fee applies, regardless of loan amount.

How do I use a contactless card at People Driven Credit Union?

Look for the contactless symbol (sideways Wi-Fi icon) at checkout. Then simply:- Tap your card on the payment terminal where you see the symbol.

- Hold it for a second or two — you’ll hear a beep or see a green light when the payment goes through.

- That’s it! Your card never leaves your hand, adding an extra layer of protection.

Why Contactless is Secure

Your card stays in your hand the entire time. Each tap uses a unique, one-time code so the terminal never sees your full card number. It’s one of the safest ways to pay in stores today.Common Questions

How do I use a contactless card at People Driven Credit Union? Look for the contactless symbol, tap your card, hold for a second, and you’re done. No insert or swipe needed.Get Help from Our Team

Call us at 844-700-7328 during business hours. Our team answers questions about using your contactless card. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints for Using Your Contactless Card

- First, look for the contactless symbol at checkout.

- Next, tap and hold your card near the reader for 1–2 seconds.

- Also, keep your card in your hand the entire time.

- Then, listen for the beep or watch for the green light.

- Finally, contact us at 248-263-4100 if your contactless card is not working.

Do PDCU Members Get Discounts on Dental Insurance?

People Driven Credit Union and United Concordia Dental partner together because we care about your family’s oral health. Good dental care helps your immune system and reduces your risk of illness.Available Dental Plans

You choose from three great options: Concordia Plus MI 20 Series (DHMO), Concordia Plus MI 40 Series (DHMO), or Concordia Flex (FFS). The Concordia Plus plans have no deductibles or annual maximums. Concordia Flex is a fee-for-service plan that gives you more dentist choices.Extra Savings Included

Every plan includes the Davis Vision Discount Program for savings on eye exams, eyewear, and laser vision correction. The plans focus on preventive care so you avoid expensive procedures later.How to Find a Dentist

Locate a participating dentist or check your current dentist here: Search for a Concordia Plus Dentist.What if I Have a Question?

Email United Concordia Dental Customer Service at United Concordia Customer Service or call their toll-free number. After you enroll, visit My Dental Benefits for claim history, eligibility information and more: eligibility information and more.Get Help from Our Team

Call us at 844-700-7328 during business hours. Our team answers questions about dental insurance discounts and helps you enroll. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints for Dental Insurance

- Compare the three plan options to find the best fit for your family.

- Use the dentist search tool before your first visit.

- Choose network dentists to keep costs low.

- Take advantage of Davis Vision discounts on eye care, too.

- Contact us at 248-263-4100 for help choosing dental insurance discounts at PDCU.

How do I view my Love My Credit Union Rewards and member benefits at People Driven Credit Union?

Visit Love My Credit Union Rewards to view all your perks, such as discounts from our partners, and view all the benefits available to members of People Driven Credit Union.How do I view my Love My Credit Union Rewards and member benefits?

Follow these two quick steps to see everything available to you right now:- Go to Love My Credit Union Rewards to explore hundreds of discounts on travel, shopping, dining, entertainment, and more.

- Visit our Member Services page to review all the additional benefits included with your membership.

Popular Perks You Can Enjoy Today

Save on hotels, theme parks, movie tickets, car rentals, and everyday purchases. Many members save hundreds of dollars each year simply by using their free member rewards.Common Questions

How do I view my Love My Credit Union Rewards and member benefits? Visit Love My Credit Union Rewards to view all your perks such as discounts from our partners, and view all the benefits available to members of People Driven Credit Union.Get Help from Our Team

Call us at 844-700-7328 during business hours. Our team helps you access your Love My Credit Union Rewards and explains every member benefit. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints for Using Your Rewards & Benefits

- First, bookmark both links so you can check them easily every month.

- Next, search for discounts in your favorite categories, such as travel or dining.

- Also, show your membership when shopping at partner locations.

- Then, review the full Member Services page for insurance, financial tools, and more.

- Finally, contact us at 248-263-4100 if you need help redeeming any reward or benefit.

What Is a Line of Credit?

A line of credit at People Driven Credit Union is a revolving Home Equity Line of Credit (HELOC). You borrow only what you need up to your approved limit, repay it, and borrow again — just like a credit card but secured by your home.How a HELOC Works.

Enjoy a 10-year draw period with interest-only payments on the amount you use. After the draw period, a 20-year repayment begins. Rates start as low as 6.50% APR and adjust with the Prime Rate. Minimum line is $5,000 with financing up to 100% loan-to-value.Popular Uses for a this type of loan.

Members use their line of credit for home renovations, education costs, debt consolidation, emergencies, or major purchases. You pay interest only on what you borrow, which often saves money compared to a traditional loan.Common Questions

What is a line of credit? This type of loan allows you to borrow in increments, repay it and borrow again as long as the line remains open.Get Help from Our Team

Call us at 844-700-7328 during business hours. Our team explains what a line of credit is and helps you apply. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints

- Understand you only pay interest on the amount you actually use.

- Apply online at our HELOC page for fast pre-approval.

- Keep your home equity strong to qualify for the best rates.

- Consider a line of credit instead of a lump-sum loan when you need flexibility.

- Contact us at 248-263-4100 to learn exactly what a line of credit can do for you.

What should I do if my People Driven Credit Union Visa credit card is lost or stolen?

If your Visa credit card is lost or stolen, contact People Driven Credit Union immediately to report it and protect your account.What to do right away

- Call PDCU as soon as you notice the card is missing on our dedicated Visa credit card line at 800-543-5073

- Request card lock/replacement and review recent transactions.

- Update any recurring payments tied to the old card once replaced.

5 Helpful Hints After Reporting Your Visa Credit Card Lost or Stolen

- Monitor your account daily in the MyPDCU app and report any unfamiliar activity immediately.

- Update all recurring payments (subscriptions, utilities, insurance, online merchants, etc.) with your new card details as soon as it arrives.

- Activate your replacement card right away by calling the number provided on the sticker or contacting Member Services.

- Enable real-time transaction alerts in the app or online banking so you get instant notifications for every charge.

- Contact our Member Center at 248-263-4100 for extra help, fraud-prevention tips, or to discuss additional account protections.

How do I make a payment on my People Driven Credit Union Visa credit card?

You can make your People Driven Visa credit card payment through approved online, mobile, or supported payment channels.Payment options

- Online payment through digital online tools

- Automatic payment setup for monthly due dates

- Phone 844-700-7328 or branch-assisted payment options when needed

Make a Payment Online or in the App

Log into the MyPDCU mobile app or website at my.peopledrivencu.org. Go to the Transfers section. Select your checking or savings account. Then choose your Visa credit card as the destination. You can make one-time payments or set up recurring ones. Most payments post the same business day.Set Up Automatic Payments

We strongly recommend automatic payments (Autopay). You choose the amount and date. Options include minimum payment, full balance, or a fixed amount. This method helps you avoid late fees and protects your credit score. Setup takes just a few minutes in the app or online banking.Common Questions

Can I automate card payments? Yes, recurring payment options are available based on your account setup.Other Ways to Pay

Call our Member Services team at 844-700-7328 during business hours. They can process your payment over the phone. You can also visit any of our branches in Livonia, Southfield, Warren, Ypsilanti, or Romeo. For mailed payments, send your check to People Driven Credit Union, PO Box 984, Southfield, MI 48037.5 Helpful Hints for Making Your Visa Credit Card Payments

- Set up Autopay in the MyPDCU app. It is the easiest way to pay on time every month.

- Submit your payment 1–2 business days before the due date. This gives time for processing.

- Use the mobile app for fast payments anywhere. You only need an internet connection.

- Pay more than the minimum whenever possible. This reduces your interest charges faster.

- Contact us at 248-263-4100 if you need help with payments or your statement.

How do I check my loan application status at People Driven Credit Union?

You can check your loan application status by contacting People Driven Credit Union or your assigned loan specialist. Many members ask how do I check my loan application status because they want fast updates on their progress.How to check the status

- Call PDCU member or loan support at 248-263-4100.

- Have your identifying information ready for verification.

- Ask whether any additional documents are needed to proceed.

Call for Your Status Update

Pick up the phone and dial 248-263-4100 during business hours. Our loan specialists answer right away. Give them your name, application number, or Social Security number. They pull up your file instantly.Prepare for the Call

Have your driver’s license or member number ready. Note any recent emails or letters from us. This speeds up the process so you get answers faster.Common Questions

How long does a review usually take? Timing varies by loan type and application volume, so contact PDCU for your current status timeline.Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team checks your status right away. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints for Checking Your Loan Application Status

- Call early in the day for shorter wait times.

- Write down your application number before you call.

- Ask for an email summary of your current status.

- Check your spam folder for any updates from PDCU.

- Contact us at 248-263-4100 if you need to submit more documents.

How do I access financial counseling at People Driven Credit Union?

Yes, People Driven Credit Union offers access to financial counseling resources through trusted partner services. Many members ask how they can get financial counseling help when facing money challenges.What support is available

- Debt and credit counseling guidance

- Budgeting and financial wellness resources

- Education-focused support for better financial decisions

- Reach out to GreenPath today at 877-337-3399

Available Financial Counseling Services

We connect you with certified counselors. They offer one-on-one sessions about debt management, credit improvement, and budgeting strategies. You learn skills to make smarter financial decisions every day.How to Get Started with Financial Counseling

Contact our Member Center at 248-263-4100. Tell the representative you need financial counseling. They match you with the best partner service for your situation. The process is confidential and supportive.Common Questions

How do I get started? Contact PDCU to connect with the right counseling resource based on your current needs.Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team connects you with financial counseling quickly. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints for Accessing Financial Counseling

- Call during quieter morning hours for faster service.

- Write down your main financial concerns before you call.

- Ask about free or low-cost counseling options first.

- Keep your member number handy for quick verification.

- Contact us at 248-263-4100 anytime you need financial counseling support.

How do I skip a payment at People Driven Credit Union?

People Driven Credit Union may offer skip-a-payment opportunities during eligible periods and for qualifying loans. Many members ask how skipping a payment helps when they need temporary relief.How skip-a-payment works

- Eligibility can depend on loan type and payment history.

- Program windows and terms may vary during the year.

- A fee or additional interest impact may apply.

Skip-a-Payment Requirements

You must be in good standing with all loans current. The $35 fee must be available in your checking or savings account. Most consumer loans qualify. Exclusions include Fresh Start Auto loans, lines of credit, mortgages, commercial loans, credit cards, and several other special loan types.To get started, you can either complete the process through the MyPDCU app, via PDCU’s Online Banking portal or by filling out a Authorization Form and submitting it to any of our branches or mailing it to:

Skip-A-Payment People Driven Credit Union 24333 Lahser Road Southfield, MI 48033Common Questions

How do I know if I qualify? Contact PDCU to confirm current program details, eligibility, and timing.Get Help from Our Team

Call us at 248-263-4100 during business hours. Our team checks your eligibility right away. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo.5 Helpful Hints for Skipping a Payment

- Call at least one business day before your payment is due.

- Have your loan number and member number ready.

- Ensure $35 is available in your account for the fee.

- Remember interest still accrues during the skipped month.

- Contact us at 248-263-4100 to confirm your loan qualifies.

How do I make a loan payment at People Driven Credit Union?

You can make a loan payment through People Driven Credit Union using online tools, automatic options, or approved payment channels. Many members ask how to make a loan payment because the options are fast and convenient.Ways to make a loan payment

- Pay through online or mobile banking.

- Set up recurring automatic payments.

- Use approved in-branch or phone-supported options when needed.

Pay Online or in the Mobile App

Log into online banking at my.peopledrivencu.org or open the MyPDCU app. Go to Transfers. Select your checking or savings account as the source. Choose your loan as the destination. Enter the amount and submit.Set Up Automatic Loan Payments

Enroll in AutoPay from your People Driven checking or savings account. This ensures your payment is made on time every month. AutoPay may also qualify you for a 0.25% rate discount on eligible loans. Call to set it up or do it yourself in online banking.Common Questions

Can I set automatic loan payments? Yes. Many members choose auto-pay for consistency and fewer missed payment risks.Other Payment Options

Call Member Services at 844-700-7328 during business hours. They process payments over the phone. You can also visit any branch in Livonia, Southfield, Warren, Ypsilanti, or Romeo to pay in person.5 Helpful Hints for Making Your Loan Payment

- Make payments at least one business day before the due date.

- Enroll in AutoPay to never miss a payment and possibly save on interest.

- Use the mobile app for payments anytime and anywhere.

- Keep your loan number handy when calling or visiting a branch.

- Contact us at 248-263-4100 if you need payment arrangements.

People Driven Credit Union is an Equal Housing Opportunity Lender

People Driven Credit Union is an Equal Housing Opportunity Lender